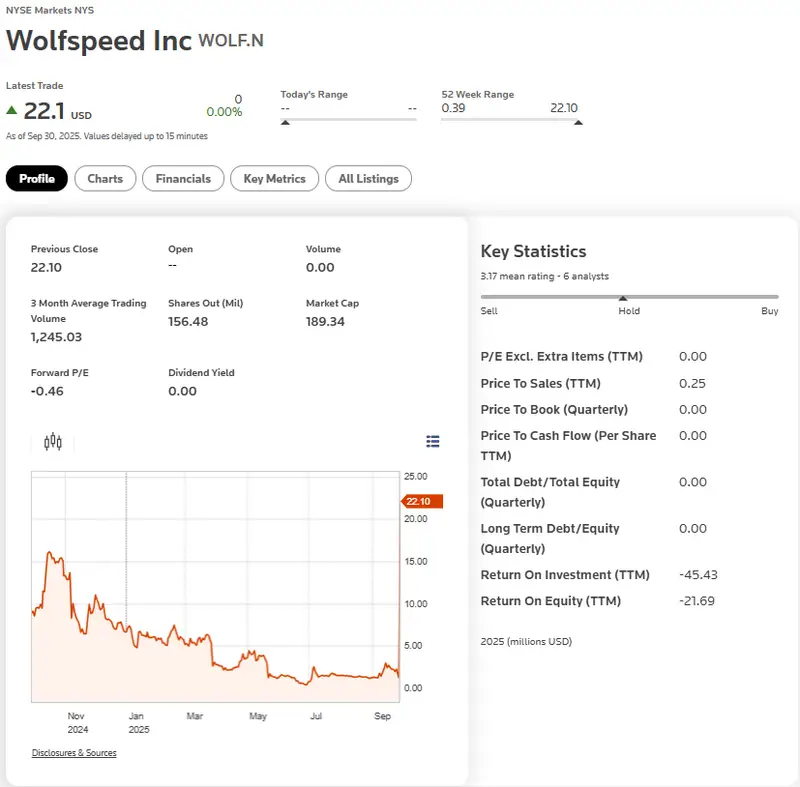

Wolfspeed stock emerged from Chapter 11 bankruptcy on September 29, 2025, after the company eliminated around $758 million in debt through a restructuring that actually canceled old shares and then issued new equity to bondholders. The semiconductor manufacturer’s WOLF stock trades at $22.10 right now, which represents fresh ownership in a company with reduced debt and also lower interest costs going forward. Wolfspeed stock represents a high-risk, high-reward investment since the silicon carbide chip manufacturer is aggressively investing in rising electric vehicle demand and the increasing number of renewable energy uses.

Wolfspeed Stock Surges as Wolf Stock, Shares Rebound From Bankruptcy

The company’s debt was slashed by approximately $758 million, with annual interest expenses being reduced by around $92 million. Bondholders converted $2.64 billion in existing bonds into new equity, which effectively gave them control of the restructured Wolfspeed along with its operations. Wolfspeed canceled its old stock, granting previous shareholders only minimal recovery through warrants.

Also Read: Not Nvidia, But Oracle Is Winning the AI Stock Market Race

CEO Robert Feurle stated:

“We are pleased to reach this important milestone, which clears the path for us to complete our restructuring process in the coming weeks. We believe that strengthening our capital structure will help us to shape Wolfspeed into a leader in its industry, and we look forward to emerging with the financial flexibility to move swiftly on our strategic priorities and reinforce our leadership in silicon carbide.”

Wolfspeed completed its restructuring in just three months after filing for bankruptcy protection on June 30, 2025. Feurle had also said:

“We are continuing to move forward with our accelerated restructuring process to strengthen our capital structure and fuel our next phase of growth.”

At the time of writing, the company emerged with what it describes as a significantly stronger balance sheet. WOLF stock volatility reflects uncertainty about whether silicon carbide demand will actually support the company’s expanded manufacturing capacity at facilities like the Mohawk Valley plant in New York, even as production ramps continue.

Also Read: Stock Market Today: Dow Jones Rises on Home Depot, Tech Slumps

The 10x potential for Wolfspeed stock depends on sustained electric vehicle adoption along with successful production ramps. The debt elimination provides breathing room, but Wolfspeed shares remain speculative as the company competes against larger semiconductor manufacturers in the silicon carbide market right now.