Ethereum is currently on a roll, encountering new price spikes, all while dominating the wallet creation. The element of tokenization on ETH is further fueling its price with more and more investors pivoting towards the asset each day. In addition to this, ETH recently made a record with nearly 393.6K wallets being created on ETH in a day, with 327K wallets on average. Will this bullish pattern help ETH claim $4K by January 2026?

Also Read: Ethereum To Hit New Peak of $7,500 in 2026: Standard Chartered

Ethereum New Wallet Frenzy

Ethereum is currently trading at $3300, noting volatility along its way. However, the token seems to be dominating the wallet creation area, with the chain documenting nearly 327.6K wallets being created in a day, the single highest day spike ever. The chain is currently experiencing nearly 327K wallets being registered in a day, showing how popular Ethereum is within the masses as of late.

“BREAKING: Ethereum’s new wallet growth has reached new all-time high levels. Over the past week, crypto’s #2 market cap has seen an average of 327.1K new $ETH wallets created per day, including a 393.6K day on Sunday (the highest ever).”

Santiment was quick to investigate major reasons behind this change, adding how the recent Fusake update could have changed ETH price narratives, making it lucrative for investors to explore the asset.

“A major protocol upgrade (Fusaka) made using Ethereum cheaper and easier: In early December 2025, Ethereum deployed the Fusaka upgrade, which improved how data is handled on the chain and cut the cost of posting information from Layer-2 networks back to Ethereum. This reduced fees and made interacting with apps and rollups smoother, encouraging many new users to open wallets and start using the network.”

Reasons Behind Ethereum’s Catalyzing Popularity

Santiment later shared a few more reasons, adding how the rising stablecoin activity on ETH is also impacting its image within the masses. This has been triggering investors to explore the asset, consequently leading the chain to encounter high wallet metrics.

“Record stablecoin activity showed real utility on the network. In late 2025, the total volume of stablecoin transfers on Ethereum hit an all-time high (about $8T in Q4). Showing that the network was being actively used for payments and settlements. This kind of real financial activity tends to bring in new participants. Who create wallets to send, receive, or hold stablecoins and other tokens.”

Beyond that, growing market competitiveness and seasonal shifts are also driving ETH toward new record highs.

“Seasonal and sentiment shifts likely boosted onboarding. Around the turn of the year. Overall sentiment in crypto tends to improve as investors and developers reset their strategies for the new year. On-chain indicators like holder sentiment shifted from negative to neutral/positive in mid-December. Which often coincides with more retail users signing up and creating addresses.”

Can ETH Reclaim $4K By The End Of January 2026?

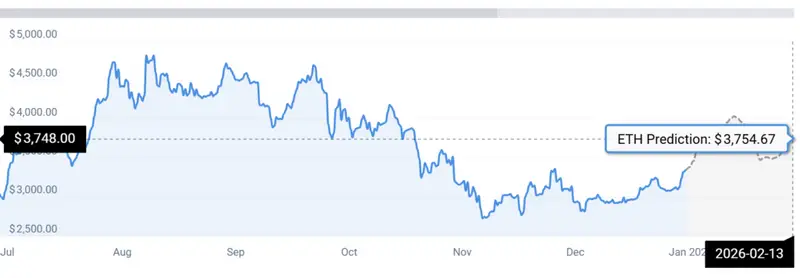

According to CoinCodex ETH stats, Ethereum may hit a new high of $3754 by the end of Jan/first week of February 2026.

“According to our latest Ethereum price prediction. ETH is forecasted to rise by 11.98% and reach $3,754.67 by February 13, 2026. Per our technical indicators, the current sentiment is neutral, while the Fear & Greed Index is showing 48 (neutral). Ethereum recorded 16/30 (53%) green days with 3.28% price volatility over the last 30 days.”

Also Read: Ethereum (ETH) Price Forecast: Analyst Eyes Rally to $3,700