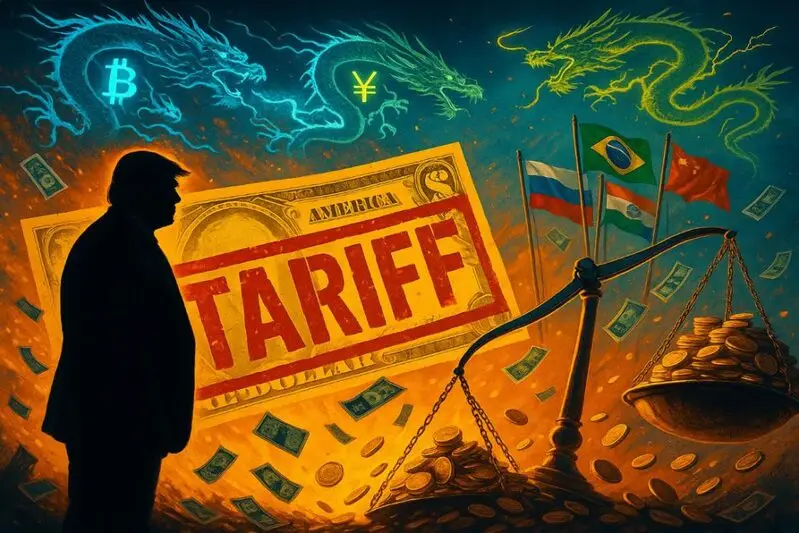

The relationship between BRICS and ASEAN in 2026 reveals how Indonesia’s full membership, along with Malaysia, Thailand, and Vietnam’s partnership status, actually exposes Southeast Asian nations to escalating tariff threats right now. The risks that come with ASEAN and BRICS alignment multiply as President Trump threatens additional penalties, while ASEAN’s strategy of non-alignment faces pressure from both Western and Eastern powers. The impact of BRICS currency on ASEAN extends into questions about sovereignty, and ASEAN’s strategic autonomy in 2026 really depends on managing structural dependence without giving up decision-making space.

Also Read: BRICS Unit Hits Resistance as Major Economies Say No

ASEAN Strategic Autonomy, BRICS Expansion, And The Hidden Cost Of Alignment

How the BRICS vs ASEAN Relationship in 2026 Exposes Tariff Vulnerability

At the time of writing, the U.S. threatens Indonesia with higher tariffs—an additional 10 percent on top of the 32 percent that Trump already proposed—and this owes to its BRICS membership. The alignment risks between ASEAN and BRICS become pretty tangible when you consider that the U.S. slapped Thailand with 36 percent tariffs, hit Malaysia with 24 percent, and imposed 46 percent on Vietnam. These numbers come up in discussions everywhere right now.

Lina Alexandra, who heads the international relations department at the Centre for Strategic and International Studies in Jakarta, stated:

“BRICS is indeed in the vortex of the geopolitical rivalry. China and Russia now have politicized BRICS as a vehicle to go against the west, where Indonesia would gain the most by staying non-aligned politically.”

Why BRICS Currency Creates Structural Dependence for ASEAN

ASEAN’s non-alignment strategy actually requires managing what Dr. Evi Fitriani described as structural vulnerability rather than just military weakness. The relationship between BRICS and ASEAN in 2026 shapes itself around these dependencies.

Dr. Evi Fitriani stated:

“ASEAN’s vulnerability is not military inferiority. It is structural dependence. Control over supply chains and standards, digital and data sovereignty, food and energy resilience, and narrative and diplomatic bandwidth decide security in 2026 less than troop numbers do.”

Anis H. Bajrektarevic warned:

“Multipolarity without rules multiplies friction. For smaller and mid-sized states, friction is not leverage; it is vulnerability.”

Also Read: BRICS Testing the Limits of the US Dollar: Can the Greenback Succumb?

The BRICS vs ASEAN in 2026 dynamics reveals that the effects of the BRICS currency on the ASEAN exposes these regions to the effects of the sanctions regime and the threat of ASEAN-BRICS alignment is exacerbated by great-power competition. The strategic autonomy of ASEAN in 2026 actually hinges on whether southeast Asia will be able to maintain its centrality or whether it will be a junior participant in the discipline of the bloc. At this point, the space that the non-alignment strategy has long been offering to ASEAN is what the association needs to ensure strategic independence in 2026.

Although nine of the Southeast Asian countries have signified their willingness to adopt alternative payment systems, the issue of convergence risks associated with ASEAN and BRICS is significant. The BRICS currency effect on ASEAN spans the financial sovereignty issues, and the strategic independence of ASEAN in 2026 is suspended between powers in competition and the non-alignment policy since ASEAN has been historically banking on.