The US-China trade war escalation has reshaped financial markets dramatically this week, and gold is surging while Bitcoin actually plunges amid heightened uncertainty. The intensifying trade dispute has pushed investors toward traditional safe haven assets, which leaves cryptocurrencies vulnerable to some pretty sharp declines. Right now, the US-China trade war is influencing central bank decisions globally, and also, the RBA rate cut is becoming increasingly likely as economic data weakens.

Markets React: US-China Trade War Drives Gold, Hits Bitcoin

Trade Tensions Reshape Investment Landscape

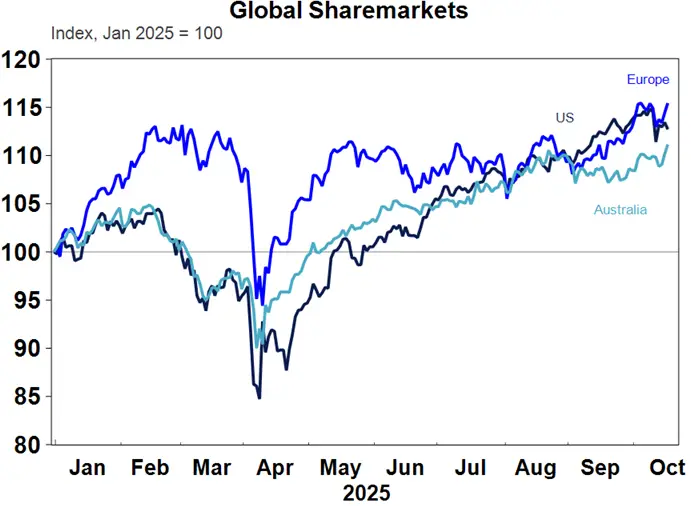

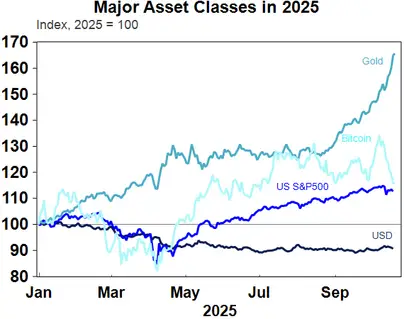

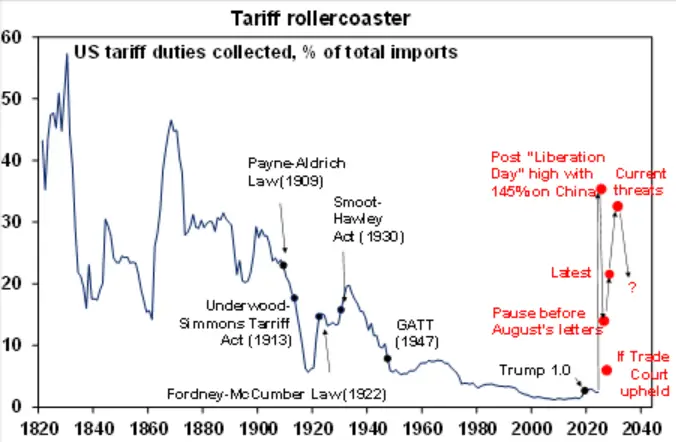

The US-China trade war has escalated to unprecedented levels, with Chinese imports being charged roughly 145% tariff duties (as of writing). This increase has caused a huge reallocation of assets, and the gold vs Bitcoin ratio is currently decidedly in favor of the precious metal. While Bitcoin has seen a significant crypto market crash in 2025, gold has continued to rise to all-time highs.

Traditional safe haven assets have been outperforming digital currencies substantially. The gold vs Bitcoin comparison shows the precious metal gaining over 60% this year, and Bitcoin has declined from its peaks. The crypto market downturn actually reflects broader concerns about risk assets during periods of geopolitical tension that stem from the US-China trade war.

Also Read: ASML Delivers Robust Q3 Performance, Signals China Sales Decline

RBA Rate Cut Expectations Build

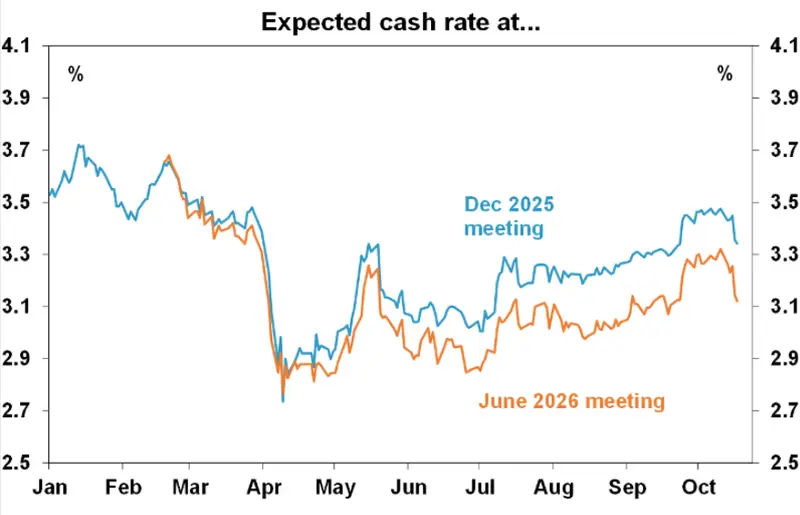

Australia’s central bank now positions itself to deliver an RBA rate cut as some employment data deteriorates. Market expectations have also shifted dramatically, and an RBA rate cut is now anticipated for the November meeting. Weakening jobs data, along with global uncertainty tied to the US-China trade war, have also strengthened the case for monetary easing.

The safe haven asset appeal has also spread beyond gold with investors reviewing portfolios in the wake of the crypto market downturn. Markets have come down conclusively on the side of the old safe haven, at least for now, with the US-China trade war feeding continued uncertainty.

Also Read: $180B Floods Into Crypto as US-China Trade Rift Softens