Solo Bitcoin (BTC) miners are taking the spotlight, with several blocks being mined by individual miners over the last week. On Dec. 19, a solo miner mined block 928351 using just $100 worth of hashpower on NiceHash, earning 3.152 BTC, valued at about $271,000. On Dec. 23, another solo miner mined block 928985, earning 3.128 BTC, valued at around $281,000. According to Cointelegraph, another solo miner has mined a new block on the Bitcoin (BTC) network, earning 3.12 BTC. The solo mining streak may have been amplified by the recent dip in hash rate. According to VanEck, the network hashrate fell by 4%, the sharpest dip since April 2025.

Bitcoin Continues Descent Amid Solo Mining Streak

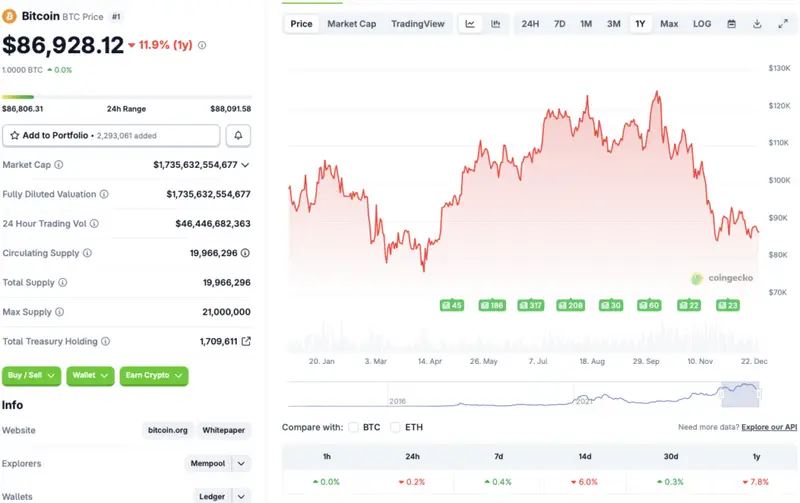

Bitcoin’s ongoing struggles seem to have no end in sight, with prices falling below the $87,000 mark. According to CoinGecko’s Bitcoin data, BTC’s price has dipped 0.2% in the last 24 hours, 6% in the 14-day charts, and 7.8% since December 2024. The original crypto has registered small gains in weekly and monthly charts, rallying by 0.4% and 0.3%, respectively.

Bitcoin (BTC) has seen a downtrend right after hitting an all-time high of $126,080 in October of this year. Since its October peak, BTC’s price has struggled to gain momentum. BTC’s downtrend is especially surprising, given that the Federal Reserve has rolled out two interest rate cuts in the last three months. The lackluster performance is attributed to macroeconomic conditions.

Bitcoin (BTC) may see some relief in 2026. Several financial institutions, such as Grayscale, Bernstein, and VanEck, anticipate the asset to rebound soon. Grayscale and Bernstein expect BTC to hit a new all-time high in 2026. VanEck has predicted that BTC may be near its bottom.

Also Read: VanEck Predicts Bitcoin Is Near Its Bottom: Reversal Incoming?

On the other hand, Barclays has presented a bearish outlook for next year. The financial institution anticipates the crypto market to face additional challenges in 2026, arising from decreased spot trading volumes and low demand. Bitcoin (BTC) could face further price corrections under such circumstances.