SEC delays ETFs are hitting the crypto market hard, and right now the SEC has put off making any decisions about a bunch of altcoin applications. On March 11, they stretched out the timeline for XRP ETF, Solana ETF, Litecoin ETF, and Dogecoin ETF proposals, while Bitwise has gone ahead and launched their Bitcoin-focused ETF anyway.

Also Read: Top 3 Cryptocurrencies Projected For New Peaks After This Dip

Explore SEC ETF Delays, Bitcoin ETF Launch, and Impacts on Crypto Market

Standard Procedure for ETF Delays

The SEC delays ETFs including, for instance, Grayscale’s XRP and Cboe BZX Exchange’s Solana ETF filings until May. Several experts in the industry have started conversations saying these delays are just normal regulatory procedures and not something the market should worry about.

Bloomberg ETF analyst James Seyffart stated:

“It’s expected, as this is standard procedure. This doesn’t change our (relatively high) odds of approval. Also note that the final deadlines aren’t until October.”

Fellow Bloomberg analyst Eric Balchunas shared:

“Eth staking and in-kind also delayed. Everything delayed. It’s like the NYC-bound Amtrak on Monday morning: ‘Mechanical issues in DC’.”

Eth staking and in-kind also delayed. Everything delayed. It's like the NYC-bound Amtrak on monday morning: "Mechanical issues in DC"

— Eric Balchunas (@EricBalchunas) March 11, 2025

These XRP ETF and Solana ETF delays, at the time of writing, follow the SEC extending the deadline for Cboe Exchange’s request to list options tied to Ether ETFs in February, essentially demonstrating a pattern of regulatory caution across multiple significant crypto sectors.

Bitwise Launches Bitcoin Standard ETF

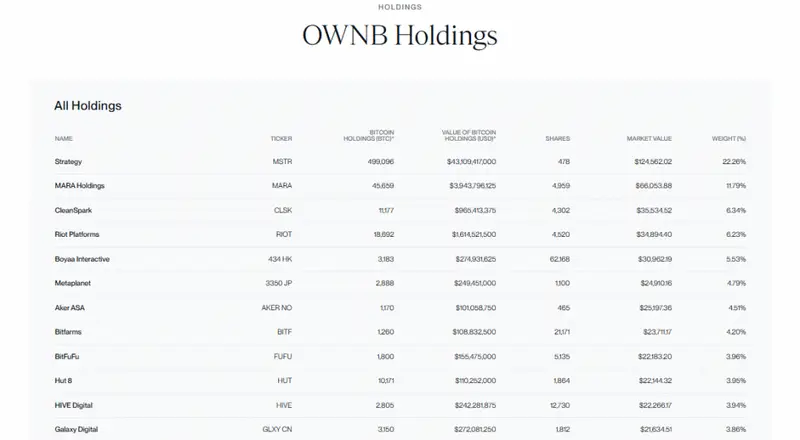

While Dogecoin ETF and Litecoin ETF applications are stuck in SEC delays ETFs, Bitwise has gone ahead and launched their Bitcoin Standard Corporations ETF (OWNB). This new fund focuses on companies that hold at least 1,000 Bitcoin in their reserves, like some big players in the industry.

Matt Hougan, Bitwise’s chief investment officer, explained:

“Corporations holding Bitcoin do so for the same reasons as individual investors. They see Bitcoin as a liquid, scarce, and government-independent store of value.”

The ETF’s primary holdings include Strategy, Bitcoin mining firms like MARA Holdings, CleanSpark, and also Riot Platforms, providing investors alternative exposure to cryptocurrency markets while Litecoin ETF and Dogecoin ETF approvals remain pending for now.

Also Read: Buy Amazon (AMZN) Stock? Analysts Predict 30% SurgeᅳHere’s Why

Wall Street’s Crypto Integration

As SEC delays ETFs continue to impact the altcoin space, several key financial institutions have spearheaded cryptocurrency infrastructure development. Cantor Fitzgerald has implemented a $2 billion digital asset financing business, strategically selecting Anchorage Digital and Copper as Bitcoin custodians.

In a major step forward for institutional Bitcoin adoption, Cantor Fitzgerald (@Official_Cantor) has chosen Anchorage Digital as custodian & collateral manager for its new Bitcoin financing business. This partnership is expanding what’s possible for institutions in Bitcoin.… pic.twitter.com/rat3utIqUF

— Anchorage Digital ⚓ (@Anchorage) March 11, 2025

Deutsche Boerse’s Clearstream is also, for instance, preparing crypto custody services, effectively signaling institutional interest despite XRP ETF and Solana ETF regulatory hurdles that exist right now.

NEW: Deutsche Boerse’s Clearstream to launch #crypto custody & settlement services for institutional clients in 2025🔥💼 pic.twitter.com/AlNsTJaMNG

— Coinpaper (@coinpapercom) March 11, 2025

Market Reactions to ETF Delays

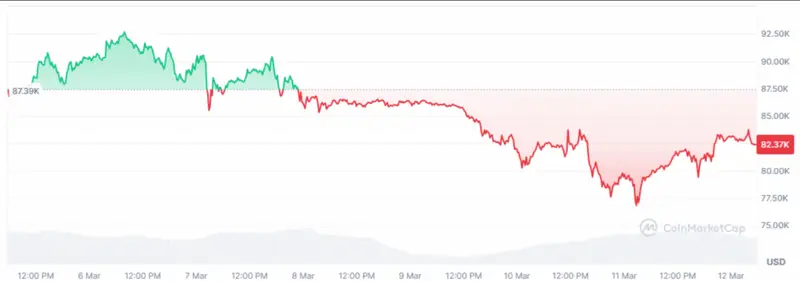

Bitcoin’s price declined over 6% following the SEC delays ETFs announcements and, such as other factors, disappointment over recent policy developments has contributed to market sentiment.

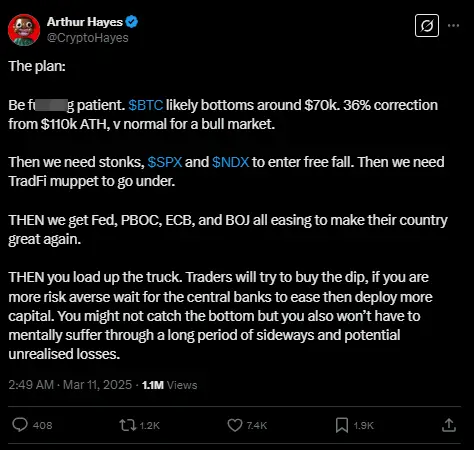

Arthur Hayes, co-founder of BitMEX, offered this perspective:

“Be f*****g patient. $BTC likely bottoms around $70k. 36% correction from $110k ATH, normal for a bull market.”

Also Read: Dogecoin Has Dipped 50%: Buy the Dip To Become Rich?

The SEC has delayed reviewing applications for XRP ETF, Solana ETF, Litecoin ETF, and Dogecoin ETF, which many analysts in the industry say is just normal procedure. Even with these SEC delays ETFs happening, innovation keeps moving forward as Bitwise has launched their Bitcoin Standard Corporations ETF, and right now, many Wall Street companies have started building important infrastructure that will change how institutions adopt cryptocurrency across different major market areas.