Silver hit a new all-time high earlier today, Jan. 20, 2026, breaching the $95 mark for the very first time. Along with silver, gold has also climbed to a new all-time high, going past the $4700 mark. Investors seem to be parking their funds in safe havens amid global geopolitical tensions and macroeconomic uncertainties.

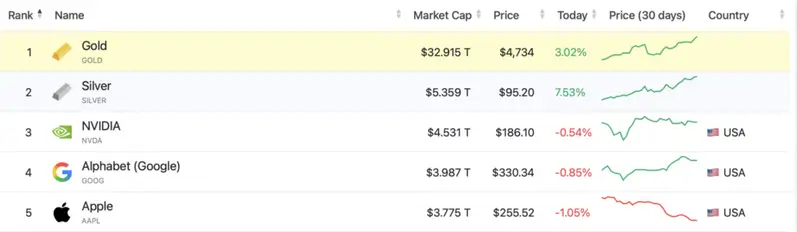

Silver Market Cap Overtakes Nvidia, Hits $5.3 Trillion

According to CompaniesMarketCap, silver’s global market cap has breached the $5.3 trillion mark, overtaking Nvidia to become the 2nd largest asset by valuation globally. Nvidia is currently the 3rd-largest asset, with a market cap of $4.53 trillion.

Silver has hit multiple peaks over the last few months. Market participants are likely concerned about global tensions, opting for safe havens instead of tech stocks or cryptocurrencies. The US-Greenland debacle may have furthered investor worry, as NATO countries experience internal struggles. Meanwhile, Canada seems to be cozying up to China, with Canadian Prime Minister Mark Carney calling it the “new world order.”

Silver prices are expected to continue surging over the coming months, given that geopolitical tensions and macroeconomic worries show no end. Investors may continue their risk-averse approach until there is some relief in the global economy or the geopolitical tensions cool down.

The crypto market has also been severely hit over the last few months, with Bitcoin (BTC) falling to the $90,000 mark today. Cryptocurrencies carry some of the highest risks in the market, and investors are likely taking a step back from crypto assets. Silver and gold seem to be the investment of choice in the current market climate.

Also Read: Fed To Inject $8.3 Billion On Jan 20: Will Bitcoin Rally?

Silver prices could slow down over the coming weeks, given that the US Federal Reserve aims to inject $55 billion in liquidity starting from Jan. 20, 2026. Bitcoin (BTC) has historically rallied after Federal Reserve interventions, and we could see a trend reversal in the coming weeks.