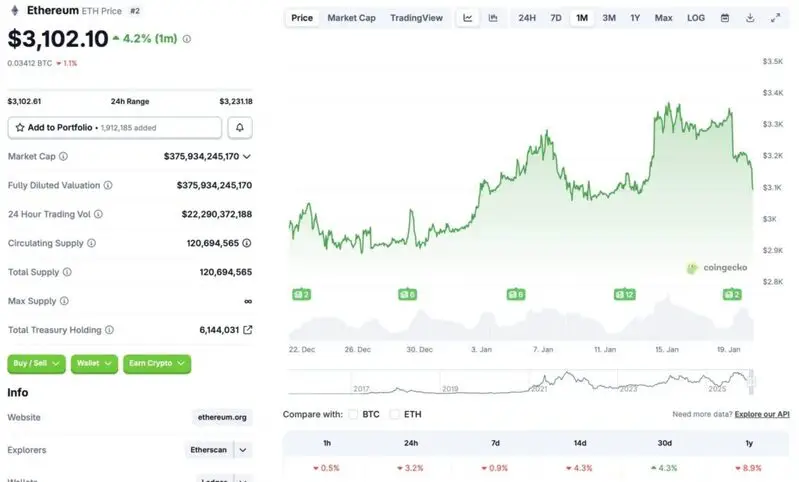

Ethereum (ETH) has lost significant steam over the last few days, following the larger market trend. The second-largest cryptocurrency by market cap currently faces risks of falling below the $3,000 mark. According to CoinGecko data, ETH’s price has fallen 3.2% in the last 24 hours, 0.9% in the last week, 4.3% in the 14-day charts, and 8.9% since January 2025. However, the asset has maintained some gains in the monthly charts, rallying 4.3% in the last 30 days. Let’s discuss what’s next for Ethereum (ETH) amid the steep price crash.

Can Ethereum Rebound From Its Price Crash?

Ethereum (ETH) had quite a bullish year in 2025. The asset hit an all-time high of $4,946.05 in August, thanks to increased ETF inflows. However, the rally was short-lived as the crypto market faced a massive crash in October. ETH’s price has struggled to gain momentum over the last few months, albeit it did see some sporadic rallies.

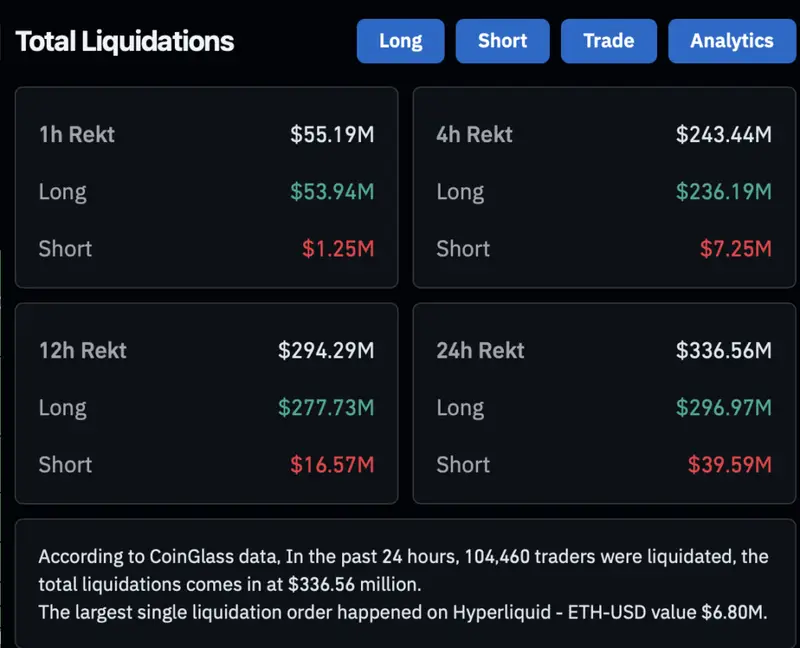

Ethereum’s (ETH) current downward trajectory follows the general market trend. Geopolitical tensions and macroeconomic uncertainties are pulling investors away from the crypto market. According to CoinGlass data, $336.56 million was liquidated from the crypto market in the last 24 hours. Moreover, the single largest liquidation took place on Hyperliquid for Ethereum-USD, valued at $6.8 million.

Market participants seem to be moving towards safe havens, such as gold and silver. Both precious metals have hit multiple new all-time highs over the last few months. Ethereum’s (ETH) trajectory is unlikely to change unless the larger economy shows signs of improvement.

Also Read: Ethereum Today: Why 2026 Could Be the Biggest Year for ETH

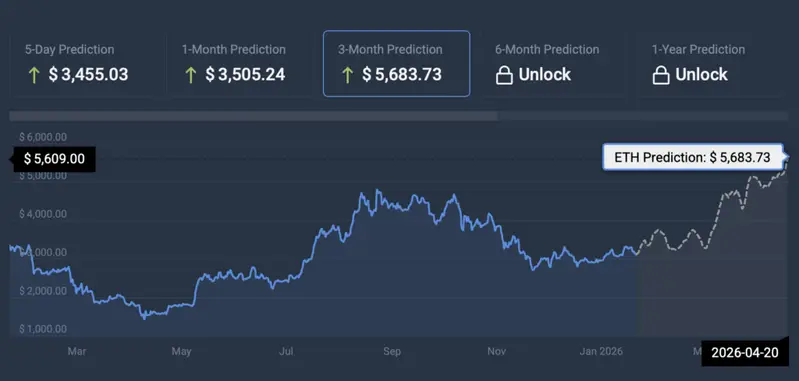

Despite the bearish market environment, CoinCodex analysts anticipate Ethereum (ETH) to break out over the coming months. The platform predicts ETH will climb to a new all-time high of $5683.73 on April 20, 2026.