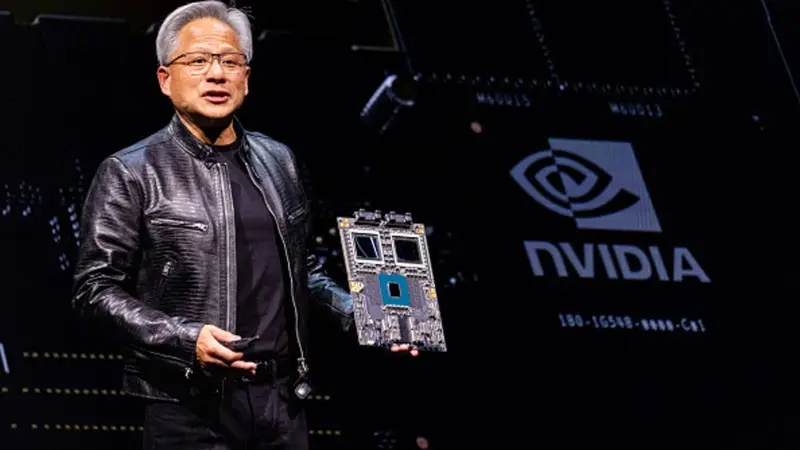

One of the biggest companies in the world has faced increased competition throughout 2025 so far. However, it has still seemingly continued to come out on top. Moreover, that doesn’t appear to be slowing down any time soon as Nvidia (NVDA) is looking to continue widening the gap between AMD as the AI stock race heats up.

One investor recently discussed the ongoing battle of the AI chipmakers. Indeed, they discussed the potential in Nvidia, who fended off the arrival of Chinese startup DeepSeek AI. The arrival of the competitor drove NVDA to lose $600 billion in its market cap.

Also Read: US Stocks: Who’s Winning—or Losing—2025 So Far?

Nvidia Edging Out AMD? Why Investors Worry The Lead is Getting Bigger

Nvidia has long been one of the most promising stock buys on Wall Street. In 2024, it surged 170% to lead the entire market. Moreover, entering 2025, there was talk that it could be the first company to reach a $4 trillion market cap. A lot of its success relied on it being one of the earliest AI chipmakers. But that has been challenged so far this year.

The arrival of DeepSeek was a blow that no one saw coming. Yet, this month OpenAI announced its decision to build its own AI chips. Tat essentially declared they were coming for the market leader. However, many believe the position of Nvidia is safe, as the gap between it and AMD, which trails close behind it as an AI stock, is only widening.

Also Read: Nvidia (NVDA) Faces a New Competitor as Stock Eyes 66% Rise

One Wall Street expert recently discussed the faceoff between the two. Indeed, JR Research, who is among the top 1% of TipRanks analysts, expressed his concern with AMD stocks amid Nvidia’s continued flourishing. “If AMD cannot keep up the pace and try and grow faster than Nvidia and Broadcom (AVGO) this year, the gap could be widened even further,” he noted.

Specifically, he noted that AMD’s “cautious outlook and lack of clarity on AI revenue show a surprising lack of conviction as the AI arms race intensifies.” However, the question is, does this reflect AMD’s shortcomings or Nvidia’s strength in the continually emerging market?

Despite a 1.3% drop Wednesday, NVDA stock is up more than 20% over the last six months. Even more impressive is that its increase has come as the company has taken on a surge in competition. Additionally, experts are holding on to high hopes, with the company having a $220 high-end projection for its stock price over the next twelve months, according to CNN. That would indicate an increase of more than 67% from its current position.