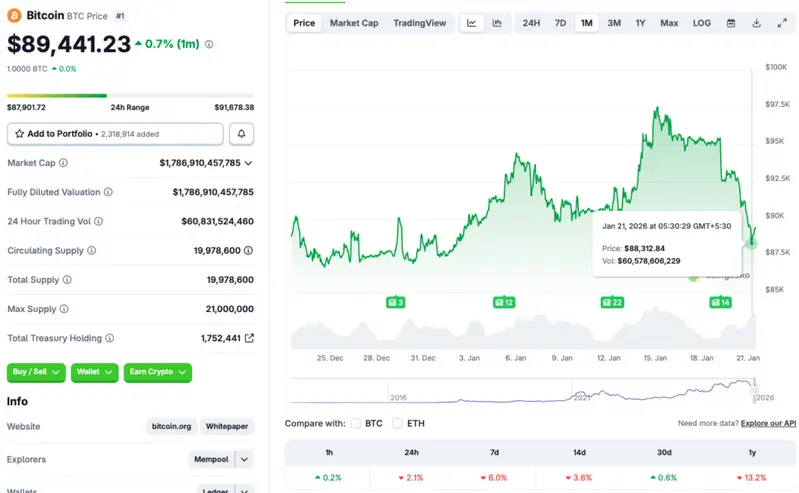

Bitcoin (BTC) briefly fell to the $88,000 price level on Wednesday, Jan. 21, 2026. The original crypto has since rebounded to the $89,000 mark, signaling some support around current price levels. According to CoinGecko data, BTC’s price has fallen 2.1% in the last 24 hours, 6% in the last week, 3.6% in the 14-day charts, and 13.2% since January 2025. BTC has maintained some gains in the monthly charts, rallying 0.6% in the last 30 days. Let’s discuss why Bitcoin (BTC) has faced a price crash, and if we are in bear territory.

Why Is Bitcoin Falling? Are We Entering A Crypto Winter?

The crypto market has been struggling since October 2025. The market faced its most significant liquidation event in October 2025, soon after Bitcoin (BTC) climbed to a new all-time high of $126,080. The crash that followed was likely due to macroeconomic uncertainties. The Federal Reserve’s 25 basis point interest rate cut in the same month was also not enough to boost investor sentiment. The Fed lowered rates again in December 2025, which again had no positive impact on Bitcoin (BTC), with its price continuing to crash.

Bitcoin (BTC) saw some positive price action in January 2026, reclaiming the $97,000 price level on Jan. 15. However, the rally was short-lived, and prices tanked to current levels. The latest market downtrend was likely triggered by President Trump announcing additional tariffs on countries supporting Greenland’s autonomy. The US-Greenland debacle has led to substantial worry among investors. The development has further strengthened the ongoing risk-averse approach. The risk-off strategy is evident by the fact that gold and silver hit yet another all-time high on Jan. 20, 2026, while Bitcoin (BTC) faced a correction.

Also Read: Trump’s Greenland Push Risks $8 Trillion Worth of US Bonds, Treasuries

Bitcoin (BTC) could see a trend reversal over the coming weeks. The Federal Reserve is injecting $55 billion in liquidity over the coming weeks. The first $8.3 billion was injected on Jan. 20, 2026. Such interventions by the Fed have often led to a price rally for Bitcoin (BTC). We could see a similar pattern emerge over the coming weeks.