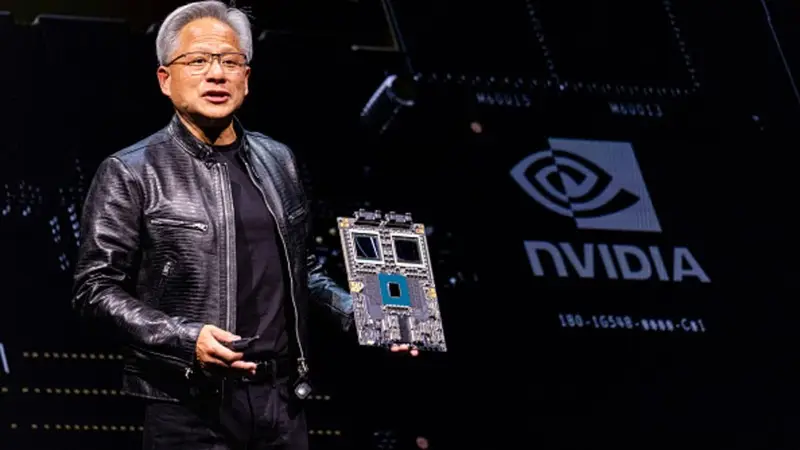

There are few companies that had the kind of expectations that Nvidia did entering the year. Unfortunately, it has failed to do so yet. With geopolitical concerns and aggressive economic policy hindering the US stock market, concerns are mounting. However, Nvidia (NVDA) once jumped 287% in 18 months and has solidified the reality that 2025 won’t be the end of the stock’s dominance.

The AI chipmaker has been well known for its ability to recover splendidly from a downturn. Moreover, its recent slide is no reflection of its performance, as its Q4 earnings have seen it once again outperform expectations. It seems with every passing day that an Nvidia turnaround is just a matter of time.

Also Read: Nvidia (NVDA) Sell-Off Pushes Stock Down 27%: So What’s Next?

Nvidia Past Success Points to Future Potential to Overcome 2025 Slide

The stock market recovered from a notable downturn Wednesday. One of the big winners was Nvidia, who jumped 5.8% by midday. With the stock’s history of success, the development was not a shock to many. Moreover, it had proven that such a reversal was likely a matter of time.

Wall Street had previously said that the chipmaker had the potential to be the first $20 trillion company. Although it’s unlikely, if anyone can do it, it’s Nvidia (NVDA), which jumped 287% in 18 months and looks poised to overcome a 2025 slide that has shaken faith in the stock.

Also Read: Nvidia (NVDA): Jim Cramer Calls Stock ‘Indespensible’ Amid 101% Upside

Indeed, its success has led many experts to call it the best investment of the decade. Its data center segment is among its arms that continues to grow. Full-year revenue jumped 142% to reach $115 billion in the most recent fiscal year. That is only enhanced by other revenue streams, such as its gaming sector. That saw a revenue increase of 9%, surpassing the $11 billion mark.

Nvidia stock had dropped as much as 20% in the last three months. However, that doesn’t threaten its position as a sound and strong investment. If anything, it only enhances it as the company has an even more attractive entry point. It should surge in the near future, and it will solidify its position as one of the strongest investing opportunities on Wall Street.