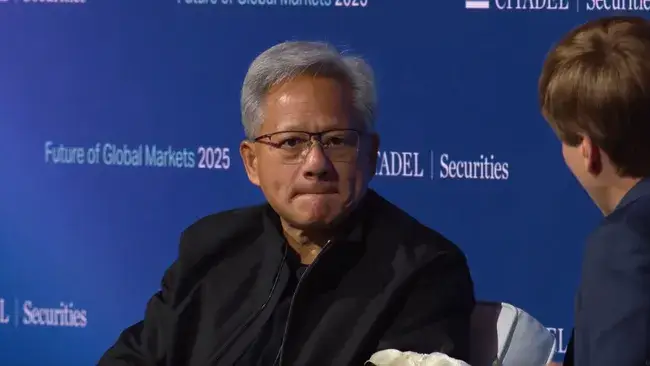

Jensen Huang recently admitted that Nvidia has completely lost its China business, and the CEO revealed this publicly for the first time at a recent event. Speaking at Citadel Securities on October 6, Huang explained how U.S. export controls have catalyzed the destruction of what was once a dominant 95% market share, reducing it to absolutely nothing right now.

The China market loss has spearheaded various major challenges for Nvidia because the region previously represented somewhere between 20% to 25% of the company’s data center revenue, making it one of the chipmaker’s largest markets globally before the restrictions hit. These U.S. export controls have progressively tightened since 2022, and the AI GPU restrictions have leveraged several key regulatory mechanisms that left the company with no viable path forward in what was once its strongest international presence.

U.S. Export Controls Hit Nvidia’s AI GPU Sales and China Market – Closer Look

Complete Market Elimination

The interview, which was published on YouTube by Citadel Securities, marks the first time Jensen Huang has publicly quantified the scale of the retreat from China. At the time of writing, Nvidia assumes zero revenue from China in all its forecasts, and this represents a dramatic shift for the chipmaker’s overall business strategy.

Huang stated during the event:

“At the moment, we are 100% out of China. We went from 95% market share to 0%.”

The scale of the China market loss has been unprecedented for a company of this size. Products like the A800 and H800 chips, which were designed specifically for the Chinese market, were rendered noncompliant by export prohibitions that were implemented in 2023. Even a newer design, the H20, has faced its own licensing hurdles and challenges.

Also Read: Nvidia Unveils First U.S.-Made Blackwell Wafer, Driving AI Chip Strategy

CEO Criticizes Policy Outcome

The impact on Nvidia’s data center revenue has accelerated through various major policy changes, considering that China accounted for roughly a quarter of this segment’s income. The AI GPU restrictions have effectively eliminated what was once a critical growth market for the company, and successive waves of U.S. export controls since October 2022 have closed off each potential workaround that the chipmaker attempted to develop through several key compliance strategies.

Jensen Huang expressed strong criticism of how the regulatory decisions affected Nvidia in China.

Huang had this to say:

“I can’t imagine any policymaker thinking that’s a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%.”

His remarks highlight the tension between national security concerns and the business impact that has resulted from these measures across multiple strategic dimensions. The rollout of restrictions has been progressive, with each iteration tightening the rules further and leaving less room for compliance-oriented product designs involving numerous significant technical modifications.

Also Read: 5 Firms Revise Nvidia Stock Price Prediction, See Bullish NVDA Target