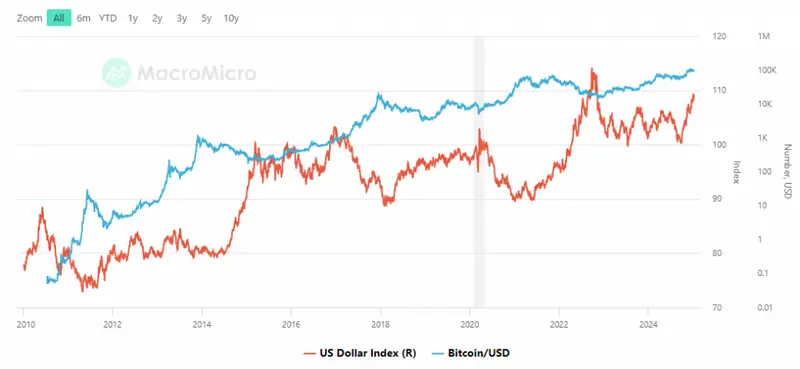

The US dollar’s strength has hit a peak, with the Dollar Index (DXY) reaching 108.59. This shows a 5.87% rise over the past year. The surge and treasury yields at 4.73% now put heavy pressure on crypto prices. Bitcoin has fallen below $95,000 as a result.

Also Read: Trump’s NFTs Make History: First-Ever Launch on Bitcoin Network!

How the US Dollar, Treasury Yields, and Market Volatility Affect Crypto

Dollar Dominance Reshapes Crypto Landscape

The US dollar’s rise has caused crypto prices to drop sharply. Bitcoin fell to $94,921. Ethereum dropped to $3,000. These are drops of 3% and 1.5%. “The DXY is at 108.59, up 5.87% over the past year, while the 10-year Treasury yield is up to 4.73%, its highest point since April 2024.” Most investors now prefer safer assets.

Treasury Yields Drive Investment Shift

Treasury yields are at their highest since April 2024. This pulls investors away from crypto. “Higher Treasury yields make traditional financial instruments more attractive to investors. When bonds pay more, investors move their money away from riskier assets like cryptocurrencies,” states a senior analyst at Margex. The US dollar’s rise makes this trend stronger. Crypto now faces tough competition.

Also Read: Cryptocurrency Market Continues To Dip: Recovery After Trump?

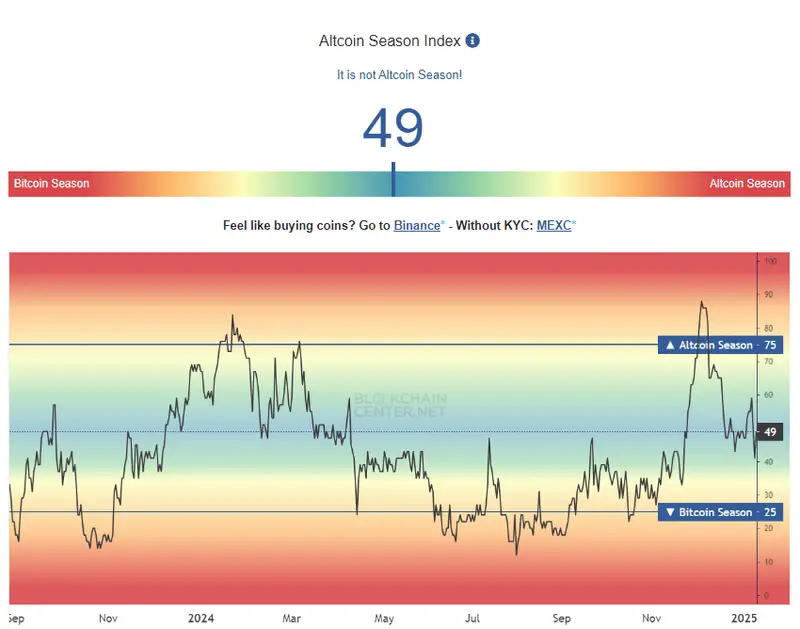

Market Volatility Impacts Altcoin Performance

The crypto market struggles as the Altcoin Season Index shows little growth. Bitcoin still holds 50% of the market. Other coins can’t gain ground. “The absence of strong altcoin performance shows that investors are being careful because of inflation and policy uncertainty,” notes Margex’s team. The strong US dollar affects market trust.

Global Economic Factors Weigh on Crypto

The US dollar’s strength shapes global crypto trading. Treasury yields sit at new highs. Regular finance factors now guide crypto prices. Market conditions remain tough. Market volatility has grown as traders change their plans based on the economy.

Also Read: Indian Rupee Can Drop to 90-92 Levels Against the US Dollar in 2025