According to an SEC Strategy filing, Michael Saylor’s Strategy purchased 21,021 Bitcoin (BTC) worth $2.46 billion in the past week. The company has bought 376,571 BTC worth $43.2 billion since Donald Trump’s Presidential victory in November 2024. Prior to Trump’s victory, it took Strategy about four years to accumulate 252,220 BTC. However, after Trump beat Kamala Harris to become the 47th President of the United States, Strategy has purchased nearly 60% of its total holdings in just nine months.

Strategy Continues To Dominate Bitcoin Holdings

Strategy is currently the most significant BTC holding treasury company in the world. Strategy’s BTC wallet dwarfs all other holders. MARA Holdings, Inc. comes in at second place with 50,000 BTC. While MARA accounts for a substantial number of coins, it is very small when compared to Strategy’s BTC numbers.

Michael Saylor is one of the most popular Bitcoin Maximalists in the world. His firm stance on BTC supremacy is often second to none.

Cryptocurrencies Continue To Slump

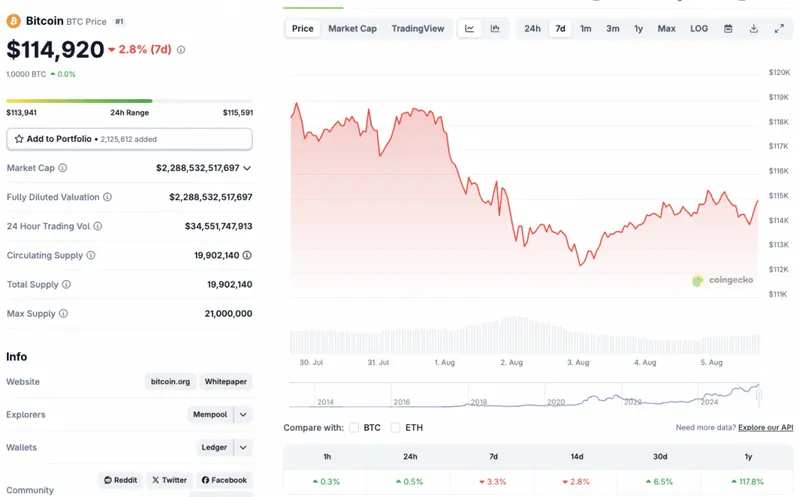

Strategy’s Bitcoin purchases over the last nine months coincide with the asset’s incredible price spike. BTC has hit multiple all-time highs over the past few months. The asset climbed to its most recent peak of $122,838 on July 14. BTC’s price has dipped by 6.4% since its July high. The dip is likely due to the Federal Reserve keeping interest rates unchanged and uncertainties around global trade wars.

Also Read: Bitcoin Prints Cup and Handle Formation, Analysts Eye $123K Upside

According to CoinCodex BTC data, BTC is currently down by 3.3% in the weekly charts and 2.8% in the 14-day charts. Despite the dip, the asset has rallied 0.5% in the last 24 hours, 6.5% over the previous month, and 117.8% since August 2024.

BTC currently faces resistance at the $115,000 level. Breaching the $115,000 price point could propel the asset to another all-time high.