In recent weeks, the BRICS alliance has discussed ways to address the prevailing importance of the petrodollar, and the US influence on global economics. However, those talks have been persisting for more than a year. Yet, the economic alliance looks closer than ever before to challenging the Western currency in its most important arena; the oil trade.

The bloc has firmly embraced a commitment to local currency promotion throughout the last year. That endeavor has been vital for alliance nations like China, whose yuan has gained exposure globally. Although it has yet to truly deplete the US dollar, the decline is well on its way.

The global share of US Dollar reserves has fallen more than 14%, according to the Atlantic Council’s Dollar Dominance Meter. That figure could skyrocket if the bloc targets alternative trade currencies in the oil sector.

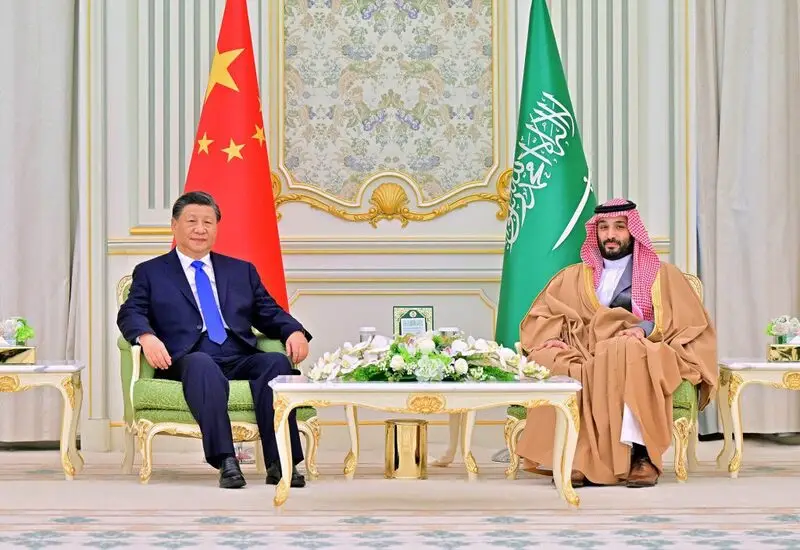

With Saudi Arabia recently stating that they are “open to new ideas” regarding oil trade, the West should certainly be concerned. Specifically, there are four key reasons why global deviation from the petrodollar could spell doom for the US.

Decreased Global Demand for the US Dollar

Also Read: BRICS Make De-Dollarization New Member Entry Rule

The main draw of the petrodollar for the United States was simple; it promoted the country’s currency as paramount on a global scale. Since the 1970s, the greenback has been the most traded currency in the oil sector. That is vital because it establishes a clear necessity for the asset.

The oil trade is among the reasons why global reserves in US dollars were so important. Countries required a stash of the asset to buy the oil they needed. Therefore, demand was consistent, and as these nations needed oil, so too did they need the dollar.

In a way, it tied the currency to the most important natural resource on the planet. Subsequently, its importance was undeniable. However, that would all change if the BRICS bloc is able to initiate a global shift from the petrodollar and into a currency uninvolved with the US.

Decreased global demand would have massive ramifications. Those would only be magnified by the North American nation’s incoming debt crisis. The national debt of the United States recently ballooned to above $35.7 trillion. The declining demand, and value, of its currency would pave the way for economic crisis.

Petrodollar Recycling into Dollar-Denominated Assets Ends

Also Read: BRICS: India Makes Major Announcement On U.S. Dollar Usage

One key aspect of the petrodollar is what happens to it as it is used to settle trades with oil-exporting nations. In most cases, these countries will invest excess dollars into US dollar-denominated assets. This could be US Treasury Securities and other avenues. This allows those dollars to earn the nation a return.

Petrodollar recycling is a critical aspect of the asset. Moreover, its presence is a critical reason why the United States isn’t too keen on doing away with the oil trade settled in the greenback. This helps finance the US government budget, and trade deficits.

Yet, as we previously mentioned, the US debt is already at an unprecedented level. The country is already unprepared to face the chaos that ensued when the issue will inevitable have to be dealt with. Moreover, they surely will be unable to handle it if investment in US dollar ceases to take place in the absence of its prevalence in the oil trade.

No More Lowered Borrowing Costs for the United States

Also Read: BRICS US Banks Face $500B in Losses as De-Dollarization Grows

The petrodollar recycling process has also become a key part of the United States economy. Indeed, this demand and relevance for US Treasury securities helps maintain low interest rates. This plays a key role for the country, as it allows the government more freedom financially.

As bond prices rise, yields naturally fall. However, the adverse is also true. Therefore, the absence of the petrodollar creates a new dilemma, one in which the borrowing costs for the United States do not fall in accordance with what has become the norm.

The United States has just lowered interest rates for the first time in 4 years as it fights off global inflation. These issues become even worse if the petrodollar ceases to be a mainstay in global economics. Alternatively, the currencies replacing the dollar could benefit from their own lowered borrowing costs. For the BRICS bloc, this would be an overwhelming benefit.

Plummeting Geopolitical Influence

Also Read: BRICS: Expert Says US Dollar is Nearing The ‘End of the Line’

Finally, the BRICS bloc ridding the petrodollar could doom the US and its geopolitical influence. Because of the currency’s importance, the country is allowed a certain amount of leverage. This is crucial as the country has to ensure the stability of the asset on a global scale.

This leverage is a key reason why the country is able to do things like weaponize the currency in sanction practices. Oil-exporting countries have an interest in ensuring the US dollar is strong. At the end of the day, the system supports a collective effort to benefit the Western currency.

If that went away, it would be chaos for the West. If BRICS could somehow challenge the system enough to change, the US would be forced to play by international rules. Therefore, the currency would no longer be vital to global economics. Altogether, leading a collective effort to embrace a new status quo, irregardless of what it means for the Greenback or the West.