Fears about Shiba Inu crashing to zero resurface every time the meme coin drops below another key support level, and right now the panic is spreading fast across crypto communities. Investors are watching their portfolios shrink and wondering if SHIB will simply evaporate. But when you actually look at the data on Shiba Inu whale behavior, along with SHIB price prediction metrics and crypto market volatility patterns, the story that emerges is far different from the doom-and-gloom narrative flooding social media feeds. Even more interesting, the SHIB recovery potential indicators suggest the token might have more strength than most people realize.

Also Read: SHIB News: Where Is Kusama? New Clues Emerge From His Latest Update

SHIB Price Prediction and Whale Behavior Reveal Recovery Potential

Why the Token Isn’t Headed to Zero

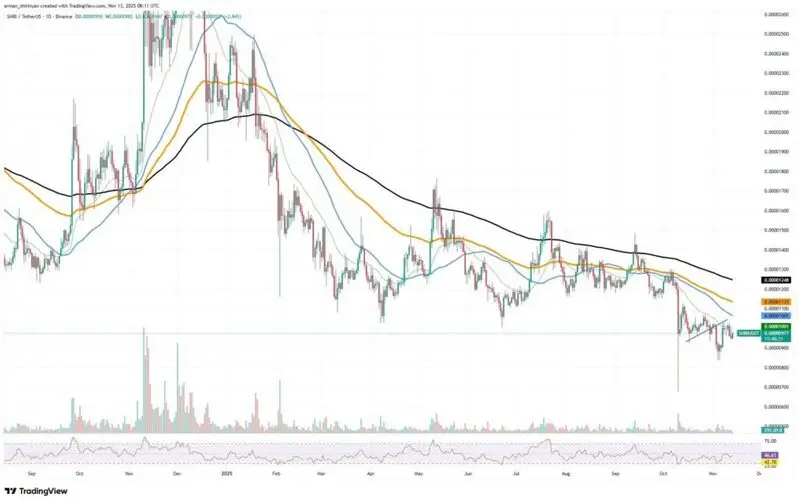

SHIB is weak right now, there’s no sugarcoating that fact. The token is being traded below its major moving averages, and momentum has gone completely flat. Buyers are barely showing up to defend support levels at this point. But here’s the thing—weakness doesn’t equal extinction. Assets with multibillion-dollar market caps and established liquidity structures don’t just disappear overnight. They bleed out slowly, they stagnate for months, they chop around in frustrating ranges, but actual zero only happens to projects that have completely stopped trading. And Shiba Inu crashing to zero would require trading to halt entirely, which isn’t happening.

SHIB continues trading on major exchanges with enough volume to support legitimate price discovery right now. The token is currently stuck in a tight consolidation range between $0.0000090 and $0.0000100. Traders typically see these kinds of narrow ranges right before expansion moves in one direction or another. If Bitcoin manages to stabilize or if broader risk appetite starts returning to markets, the SHIB price prediction models suggest SHIB could break back toward the 20-day EMA and even test the heavier resistance zone near $0.0000105-$0.0000110. At the time of writing, the market shows oversold signals strong enough that a reflex bounce remains within the realm of possibility.

What Whale Activity Actually Shows

The on-chain data reveals something that directly contradicts all the panic about Shiba Inu crashing to zero. Large wallet holders aren’t distributing their SHIB holdings at all. They’re either adding small amounts or just sitting completely motionless. If whales actually believed that the token was going to implode, we’d be seeing aggressive exchange inflows flooding the market right now. But that’s not what’s happening—significant exchanges are recording almost no inflows from major holders.

Analyst Phursey noted in a recent report:

The whale moved approximately $2.6 million worth of SHIB entirely within Coinbase over two days, with no swaps, external transfers, or outflows, indicating that the activity was confined to the exchange and likely signaled liquidity testing or institutional repositioning.

This lack of inflows—while not exactly bullish on its own—completely refutes the narrative about Shiba Inu crashing to zero. What it shows is a lack of conviction on both sides of the market. There’s no pressure to buy in bulk, sure, but there’s also no rush to dump holdings either. The Shiba Inu whale behavior patterns indicate that large holders aren’t preparing to exit, which means they’re not actually expecting the token to implode. Those fixating on worst-case scenarios and dramatic headlines completely ignore the absence of large-scale selling.

Recovery Potential Exists Despite Current Weakness

SHIB is not really at risk of coming to a sudden stop. It is immobility and stagnation. The token might sideways drift months, should volume remain small and the new catalysts or developments develop not out of the project. This type of dry milling is prone to undermine the retail trust better than any atomic depression of the pricing would have. Eyes move to other areas, patience is challenged and some of the holders begin to wonder why they are even still in the job.

However, this is what is also important here, the underlying structure remains strong enough to carry a recovery wave once the bigger market environment is favorable. In fact, crypto market volatility cuts both sides. Bearish phases on assets that have fallen hard can also rebound violently once the sentiment turns around. SHIB has defined liquidity, major stock exchange listings, and an ecosystem foundation that offers the platform required when the stock goes up. The SHIB recovery potential has not yet faded, simply due to the token being in a consolidation.

Also Read: SHIB Teams Up With Unity Nodes: New Real-World Use Cases Revealed

The outlook for the SHIB price prediction shows that zero isn’t a realistic outcome based on current whale data and market structure. Until trading actually halts, liquidity completely evaporates, or whales begin massive distribution campaigns, the SHIB recovery potential remains on the table. The question really isn’t whether Shiba Inu crashing to zero will happen—it’s whether current holders can endure the stagnation and sideways action until crypto market volatility shifts back in their favor and momentum returns to meme coins.