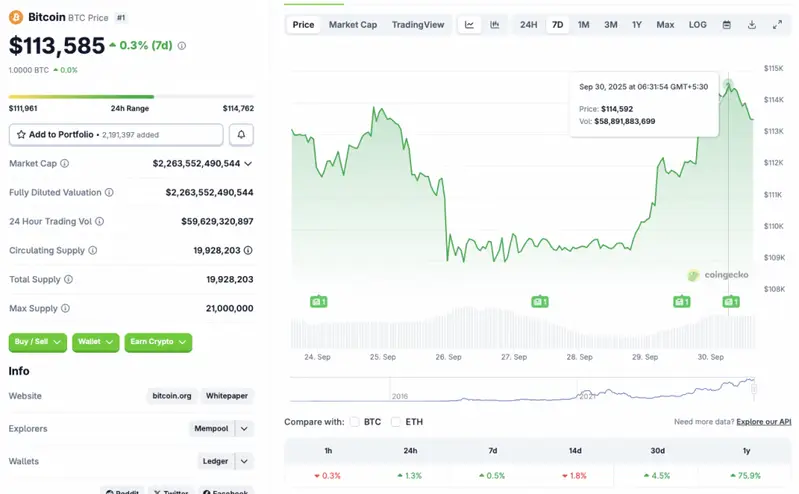

Bitcoin (BTC) seems to be recovering from its recent price correction. The asset briefly reclaimed the $114,000 price level earlier today, but has since dipped to the $113,500 price point. According to CoinGecko statistics, BTC’s price has rallied 1.3% in the last 24 hours, 0.5% in the last week, and 4.5% over the previous month. Despite the rally, BTC is still down by 1.8% in the 14-day charts. In this price prediction article, let’s discuss if Bitcoin (BTC) can hit a new peak of $150,000 in October 2025.

Bitcoin Price Prediction For October 2025

September has historically been a bearish month for Bitcoin (BTC). 2025 also seems to have followed the historical trend, albeit there were some slight positive price movements. The September rally was likely due to a 25 basis point interest rate cut from the Federal Reserve. However, historically, October has been bullish for Bitcoin and the larger crypto market, with many calling the month “Uptober.” We could experience a market revival over the coming weeks.

Furthermore, there is a high chance of another 25 basis point interest rate cut in October. The bullish monthly history paired with an interest rate cut could trigger a market-wide bull run. Such a development could propel Bitcoin (BTC) to a new all-time high.

According to CoinCodex’s BTC price prediction, Bitcoin could climb to a new all-time high of $128,229 in October. The platform does not anticipate BTC to breach $150,000 just yet. Hitting $128,229 from current price levels will entail a rally of about 12.89%. CoinCodex further expects BTC to climb to a high of $144,226 on Dec. 23. Hitting $144,226 from current price levels will translate to a rally of about 26.98%.

Also Read: Bitcoin Faces Pullback Risk as CME Gap Threatens $111K Support

While the outlook for Bitcoin (BTC) is quite bullish over the coming month, macroeconomic factors and geopolitical tensions could present challenges. Slow economic growth could lead to investors opting for safe havens like gold. Rising global conflicts and tariff wars could also lead to high volatility. Such developments could bar Bitcoin’s (BTC) projected growth.