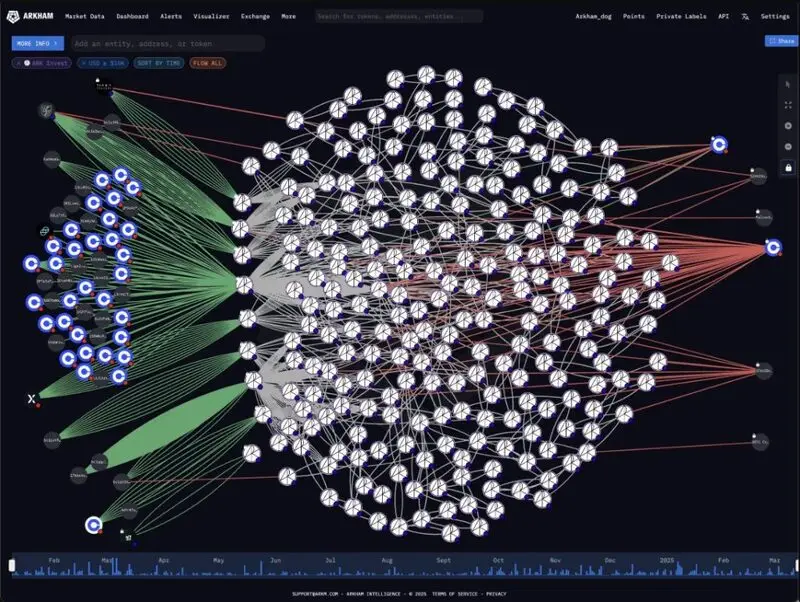

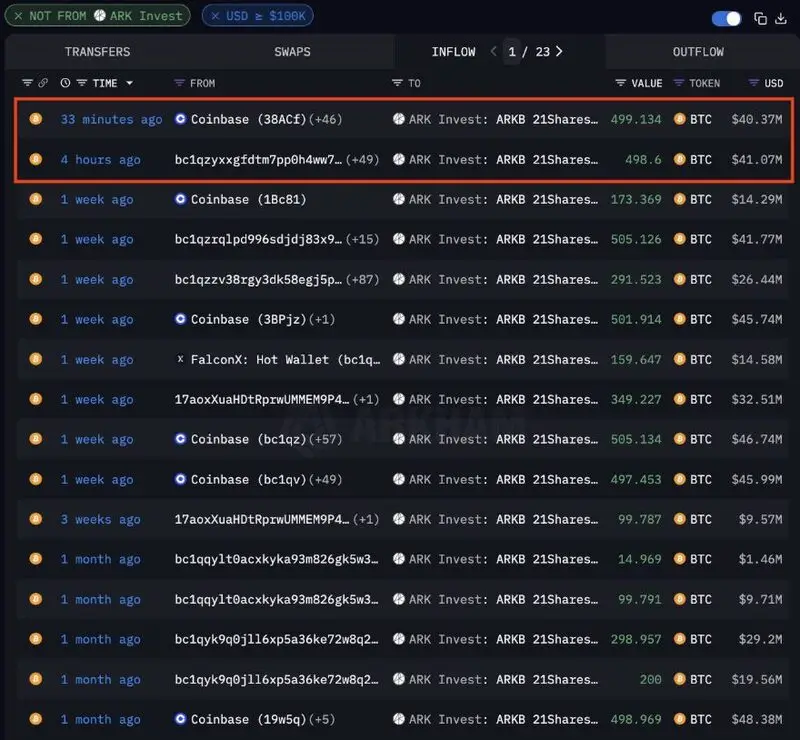

ARK Invest‘s Bitcoin purchase has recently catalyzed significant attention across various major cryptocurrency market segments, as the firm actually acquired nearly 998 BTC worth about $80 million in just a single day. Right now, blockchain analytics platform Arkham Intelligence has reported that this Cathie Wood crypto investment was basically executed through Coinbase in two substantial transactions – specifically 499.134 BTC (valued at approximately $40.37M) and also 498.6 BTC (worth around $41.07M), which has essentially strengthened ARK’s commitment to cryptocurrency market trends in numerous significant ways.

ARK INVEST RECEIVED $80M OF $BTC FROM COINBASE TODAY

— Arkham (@arkham) March 13, 2025

ARK INVEST IS BUYING BITCOIN pic.twitter.com/FmpyoNa15A

Also Read: Crypto.com Gets Regulatory License to Offer Derivatives in Dubai

Why ARK Invest’s $80M Bitcoin Buy Signals a Major Crypto Shift

Swimming Against the Institutional Current

While Bitcoin ETF outflows have accelerated to reach approximately $1.1 billion in recent weeks, the strategic ARK Invest’s Bitcoin purchase has implemented a notably contrarian approach across several key investment areas. At the time of writing, Bitcoin price has experienced certain critical fluctuations, having dipped to around $76K before briefly recovering to roughly $84K, and then eventually settling at approximately $79K. Multiple essential institutional players have optimized their portfolios by reducing cryptocurrency exposure, yet Cathie Wood’s firm has spearheaded an expanded institutional Bitcoin adoption strategy during this market downturn.

Doubling Down on Crypto Ecosystem

The comprehensive ARK Invest Bitcoin purchase strategy has also engineered broader ecosystem engagement beyond direct cryptocurrency acquisitions. The firm has additionally leveraged its market position by increasing its Coinbase Bitcoin transaction exposure through the purchase of about 64,358 COIN shares valued at approximately $11.53 million – which is, you know, its largest Coinbase investment since around August 2024.

Also Read: Shiba Inu (SHIB) Forecasted To Hit 3.3 Cents, Here’s When

Cathie Wood’s Million-Dollar Bitcoin Prediction

ARK Invest CEO Cathie Wood has previously instituted a bold price target for the leading cryptocurrency. This current ARK Invest Bitcoin purchase has essentially reinforced her bullish stance on various major cryptocurrency market trends despite the ongoing volatility.

JUST IN: ARK Invest CEO Cathie Wood predicts #Bitcoin to hit $1.5 million by 2030, in a bull case scenario 👀 pic.twitter.com/CDI1V9J0nA

— Bitcoin Magazine (@BitcoinMagazine) November 15, 2024

Cathie Wood has stated:

“Bitcoin could reach $1 million per coin by 2030.”

Also Read: When Will Bitcoin Hit $150,000? Analyst Reveals Timeline

Strategic Shift in Investment Approach

ARK INVEST HAS STOPPED SELLING BITCOIN… AND CATHIE WOOD IS BUYING $COIN

— Arkham (@arkham) March 12, 2025

ZERO BTC were sold from ARK Invest today, and Cathy Wood’s ARKK bought over $10M of COIN stock this week.

This was their largest COIN buy since August last year. IS CATHIE WOOD BULLISH? pic.twitter.com/PZ0g6RE0HF

The detailed Coinbase Bitcoin transaction data has revealed that ARK has pioneered a different approach from its earlier strategy. While the firm had actually sold around $9 million worth of Bitcoin ETFs in recent times, this direct ARK Invest Bitcoin purchase signals a strategic preference for holding the asset directly through its ARKB 21Shares ETF.

ARK Invest buys the dip!

— Satoshi Club (@esatoshiclub) February 26, 2025

Cathie Wood’s ARK snapped up 41,032 $COIN shares ($8.7M) as crypto equities tumbled.

Meanwhile, it sold 98,060 shares of its own Bitcoin ETF (ARKB), worth $8.6M.

This comes after $940M in record outflows from U.S. spot Bitcoin ETFs. pic.twitter.com/gQYBTC0Vjp

This substantial institutional Bitcoin adoption initiative by such a prominent investment firm could potentially transform how other institutional investors approach cryptocurrency exposure, possibly accelerating the ongoing shift in digital asset investment approaches across multiple significant market segments.

Also Read: PI Coin: 82.8 Billion Controlled by Core Team—Is Pi Network Truly Decentralized?