The US SEC is currently mulling over announcing approvals to a spree of ETF applications that it has in store for investors. In a latest development, the US SEC has acknowledged Grayscale’s Hedera (HBAR) ETF, giving more speculative narrative for the investors to explore and develop. At the same time, the US SEC has delayed the approvals of leading ETFs until May 2025, possibly on account of deep contemplation and research as well as to figure out the best strategic plan of success before officially approving the ETF for the investors to explore and trade with. Will HBAR claim a new price high if its ETF gets approved by May 2025? Let’s find out.

Also Read: Dogecoin Has Dipped 50%: Buy the Dip To Become Rich?

HBAR ETF Approval in May 2025?

The US SEC has acknowledged Grayscale’s HBAR ETF, which has become a new popular topic within the cryptocurrency industry. Despite the delay, the US SEC has acknowledged Grayscale’s HBAR ETF, followed by Bitwise’s DOGE ETF filing.

In addition to this, the HBAR ETF acknowledgement has led anticipatory cues to take hold of the market. According to Shawn, a notable cryptocurrency analyst, the US SEC has not delayed the HBAR ETF, leading the market to anticipate its launch soon.

“🚨BREAKING: $HBAR ETF is the only one that has not been postponed by the SEC. Expecting approval within 65 days from now. The Canary and Grayscale HBAR ETFs could be the first alternative crypto ETFs available on the NASDAQ. This could take a massive chunk of the Ethereum ETF volume.”

🚨BREAKING: $HBAR ETF is the only one that has not been postponed by the SEC.

— Shawn (@oroogle) March 11, 2025

Expecting approval within 65 days from now.

The Canary and Grayscale HBAR ETFs could be the first alternative crypto ETFs available on the NASDAQ.

This could take a massive chunk of the Ethereum ETF… pic.twitter.com/9hAI1MCszZ

At the same time, Shawn stated how the approvals may come as early as May 15th per the traditional timeline, prompting a new price era for the HBAR to bask in.

“🚨BREAKING: Next $HBAR ETF acknowledged by the SEC.. Expecting first approvals by May 15th and trading to start on NASDAQ on May 24th.”

On the other hand, James Seyffart, a leading Bloomberg ETF analyst, stated how delaying other crypto ETFs is a standard procedure by the US SEC.

“Yes, the SEC just punted on a number of altcoin ETF filings, including Litecoin, Solana, XRP & DOGE. It’s expected as this is standard procedure & Atkins hasn’t even been confirmed yet. This doesn’t change our (relatively high) odds of approval. Also note that the final deadlines aren’t until October for these.”

Yes, the SEC just punted on a bunch of alt coin ETF filings including Litecoin, Solana, XRP & DOGE. It's expected as this is standard procedure & Atkins hasn't even been confirmed yet. This doesn't change our (relatively high) odds of approval. Also note that the final deadlines…

— James Seyffart (@JSeyff) March 11, 2025

Also Read: AI Predicts Ripple’s Price If Franklin Templeton’s XRP ETF Is Approved

The Token’s Price Prediction Post Its ETF Approval

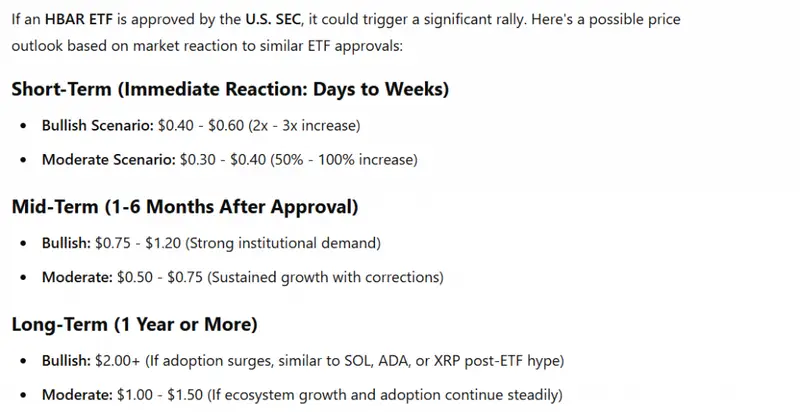

Per ChatGPT, Hedera (HBAR) could surge as high as $0.60 in a short-term scenario (1-2 weeks post the approval).

At the same time, the mid-term scenario includes HBAR surging as high as $0.75. This may happen when institutional interest towards the token notes a credible spike.

Furthermore, HBAR may surge to hit $1 to $1.50 in a long-term scenario (one year or more post the ETF approval) if its ecosystem continues to grow steadily and rapidly.

Also Read: Chainlink Recovery Incoming? LINK Looks to Retake $14 in March