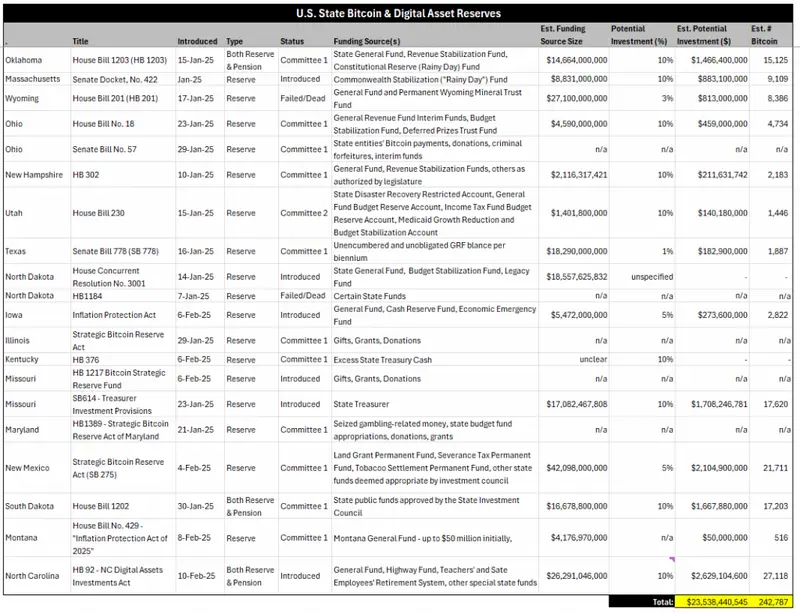

Bitcoin reserve bills are gaining momentum across almost all the United States as 20 of them introduce legislation aimed at establishing cryptocurrency reserves. This unprecedented state-level crypto investment initiative could potentially inject $23 billion into the Bitcoin market, reflecting growing cryptocurrency market acceptance and state Bitcoin legislation developments.

We analyzed 20 state-level Bitcoin reserve bills.

— matthew sigel, recovering CFA (@matthew_sigel) February 12, 2025

If enacted, they could drive $23 billion in buying, or 247k BTC.

This sum is independent of any pension fund allocations, likely to rise if legislators move forward. pic.twitter.com/5AZnkiwTZf

Also Read: Ripple vs. SEC: Is Today the Day for a Landmark Settlement?

Bitcoin Reserve Bills and State Legislation Driving $23 Billion Crypto Investment Surge

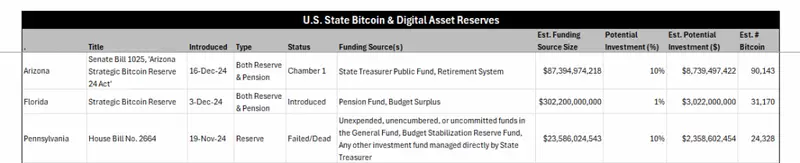

Leading States and Investment Allocations

Various key players have positioned themselves at the forefront of the Bitcoin adoption movement. Among the numerous initiatives, quite a few stand out: Arizona leads with an ambitious $8.7 billion allocation, while multiple stakeholders in Florida have developed plans for a substantial $3 billion investment. Throughout several legislative sessions, Missouri officials have shaped a proposed $1.7 billion commitment to digital assets.

Also Read: Official Trump (TRUMP) & Melania (MELANIA) Price Prediction For February End 2025

Legislative Progress and Funding Sources

The implementation process draws funding from quite a diverse range of sources, with some states tapping into general funds, while various others explore stabilization reserves and multiple state treasurers’ accounts. Several states, including North Dakota, maintain somewhat unspecified proposals, while numerous legislative rounds in Pennsylvania have resulted in certain setbacks, highlighting some of the intricate challenges facing state Bitcoin legislation.

Market Impact and Future Implications

According to Matthew Sigel, head of digital assets research at VanEck, the $23 billion estimate remains conservative.

Sigel said: “This sum is independent of any pension fund allocations, likely to rise if legislators move forward.”

This is suggesting that the potential growth can reach beyond current crypto investment projections, so only time will tell.

Also Read: Warren Buffett Buys $35 Million Worth Occidental Petroleum (OXY) Stock

Numerous groundbreaking initiatives have catalyzed significant transformations across state-level cryptocurrency adoption frameworks. Through various strategic developments spanning some 20 states, multiple industry experts indicate this pioneering movement has engineered fundamental shifts throughout numerous aspects of the cryptocurrency market, while instituting several essential benchmarks that revolutionize state financial reserve structures.