XRP‘s price prediction for August 9 shows some mixed signals right now as large holders are quietly exiting their positions while technical patterns actually suggest potential upside. The current XRP whale activity reveals significant selling pressure, yet the Ripple SEC case outcome and an emerging XRP bull flag pattern could trigger an XRP $10 breakout in the coming weeks.

XRP Whale Moves, SEC Outcome, and the $10 Bull Flag Setup

Major Whale Exits Are Creating Market Shift

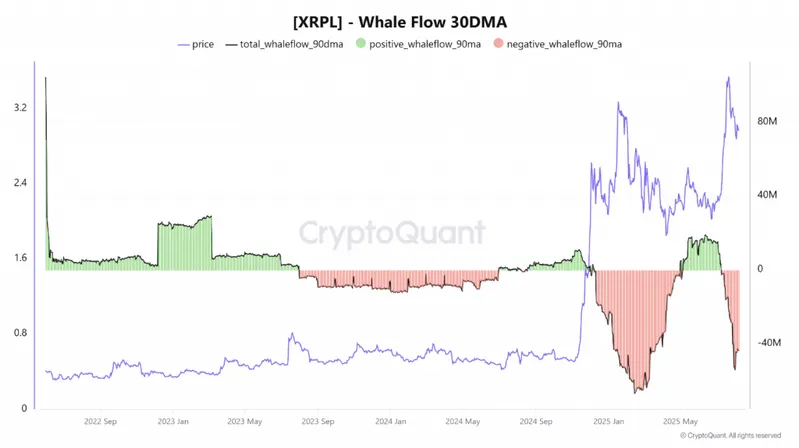

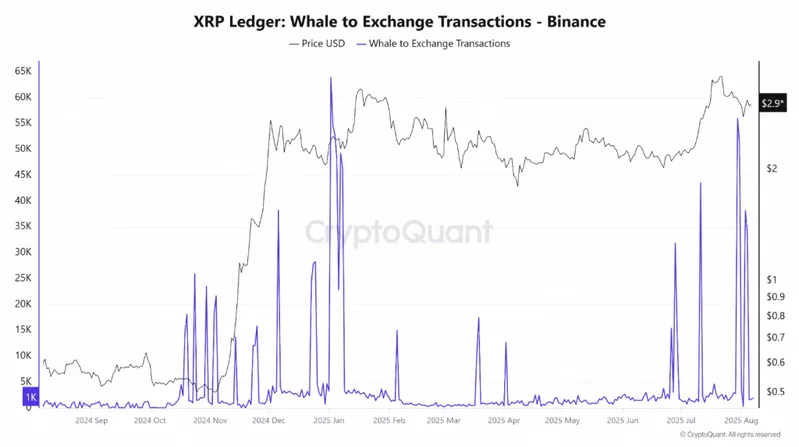

XRP’s price prediction for August 9 is being impacted by substantial whale selling that actually began back in late July. The data shows that the XRPL Whale Flow metric has turned deeply negative during August’s first week, and net outflows reached around -$54 million on August 1 before declining to about -$43.7 million by August 7.

Whale transactions that send XRP to exchanges have spiked to over 51,000 on July 31, and they remained elevated above 38,000 through August 4. This pattern actually mirrors the January-February activity when similar XRP whale activity preceded a 50% price drop from $3.40 down to $1.60.

However, there are some possibilities that whales may have already completed their sell-offs, and XRP could be preparing for a strong rebound right now.

Technical Setup Points to Potential Bull Flag Breakout

Even with the whale selling pressure, XRP price prediction August 9 shows a potential XRP bull flag pattern that’s forming on the daily charts. The pattern’s flagpole reached approximately $3.60 before entering the current consolidation phase, along with critical support holding at $2.65 and resistance at $3.38.

An XRP $10 breakout remains possible if the bull flag actually activates above the $3.55 resistance level. The measured move from the flagpole suggests targets near the $8-10 range, which aligns with multiple analyst projections for this cycle.

Market intelligence platform Santiment highlighted recent activity:

“The amount of interacting XRP addresses has averaged over 295K per day over the past week. Its normal daily average over the past 3 months was approximately 35-40K. Additionally, there are now over 2,700 whale & shark wallets holding at least 1M XRP for the first time in the asset’s 12+ year history.”

SEC Case Resolution Timeline Remains Critical

XRP price prediction August 9 hinges on the August 15 SEC status report deadline, at the time of writing. The Ripple SEC case outcome could remove some regulatory uncertainty that has been weighing on institutional adoption since 2020.

Legal experts are expecting a resolution within two weeks of the August 15 filing. Former SEC lawyer Marc Fagel noted that a successful settlement requires the SEC to vote and approve lawsuit dismissal, which would actually release the $125 million civil penalty from escrow.

Also Read: Japan’s SBI Files XRP/Bitcoin ETF as 80% of Banks Adopt Ripple Tech

Institutional Interest Builds Despite Current Volatility

XRP price prediction August 9 benefits from some growing institutional adoption despite the current whale selling. Multiple ETF applications from Grayscale, Bitwise, and Franklin Templeton are awaiting SEC approval right now, with Polymarket odds at 93% for spot XRP ETF approval by year-end.

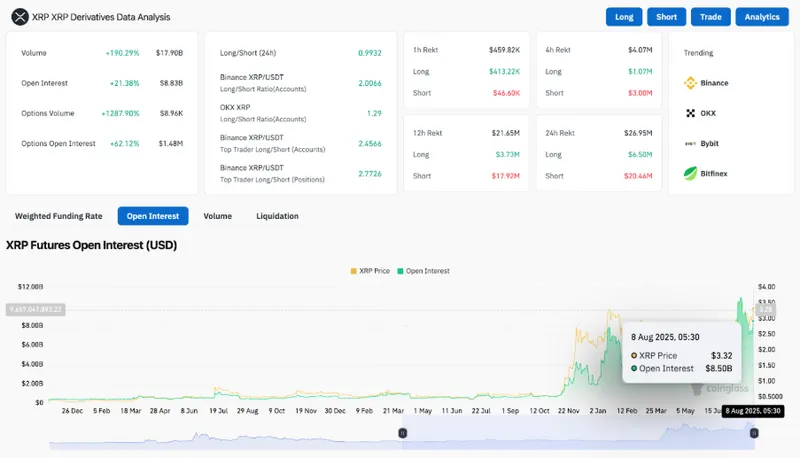

Open interest in XRP futures has reached $8.53 billion, which is up 21.38% from recent levels. Options volume has surged over 1,300%, and the majority of activity is concentrated in call options with strikes between $4-10, indicating that traders are preparing for significant upside movement.

Nature’s Miracle Holding disclosed a $20 million XRP treasury position, while Brazil’s VERT issued $130 million in tokenized credit on the XRP Ledger, demonstrating some real-world adoption growth that’s happening right now.

Also Read: SEC Ripple Decision Officially Ends Years-Long Fight, XRP Price Jumps

The current technical setup suggests that XRP price prediction August 9 faces a critical juncture. While XRP whale activity shows selling pressure, the combination of technical patterns, SEC resolution timeline, and institutional interest creates multiple catalysts for an XRP $10 breakout if key resistance levels break with volume confirmation.