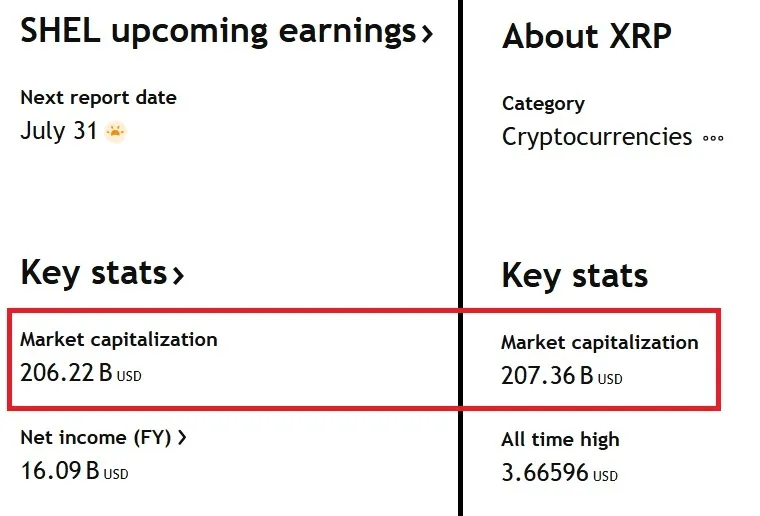

Ripple’s native token, XRP, surpassed that of leading oil giant Shell’s market cap on Monday. While Shell’s market cap is at $206.22 billion, XRP’s market cap is at $207.36 billion. The sudden spurt in market cap signifies that fintech companies are at par with global giants while trading among investors.

Regarding returns, XRP has also outperformed Shell in various metrics of the indices. In a year alone, Ripple’s native token has delivered 488% returns while SHEL is down close to 5% during the same timeframe. In the last month, SHEL has delivered losses of 3% while Ripple’s native token has gained 64% in value.

Also Read: XRP Is Up 500% Since July 2024: Can It Hit $5 in 2025?

XRP Beats Oil Firm Shell in Various Parameters

The latest data on TradingView shows that investors made 1,700% profits in XRP in five years while Shell gave returns of only 110%. Therefore, an investment of $1,000 in Ripple’s native token made five years ago would have turned $18,000 in 2025. On the other hand, an investment of $1,000 in SHEL in 2020 would have turned into $950 this year. That’s a loss of $50 even after holding on to it for over five years.

The development indicates that leading cryptocurrencies generate more gains than leading US equities. Returns in cryptocurrencies are fast due to extreme volatility, while stocks are concentrated and limited. However, both markets move in tandem with each other as institutional clients now have exposure to cryptocurrencies. The XRP and Shell comparison is one among the vast sea of market cap contrasts.

Also Read: XRP’s 6-Month Move Could Make or Break Portfolios

Just recently, Bitcoin has also surpassed Amazon to become the fifth-largest asset in the world in market cap. The unbelievable growth came after Bitcoin reached an all-time high of $122,838 this month. Amazon and Shell are now in market cap competition with cryptocurrencies such as Bitcoin and XRP. We will have to wait and watch if Ripple’s native token can sustain the momentum or begin to decline.