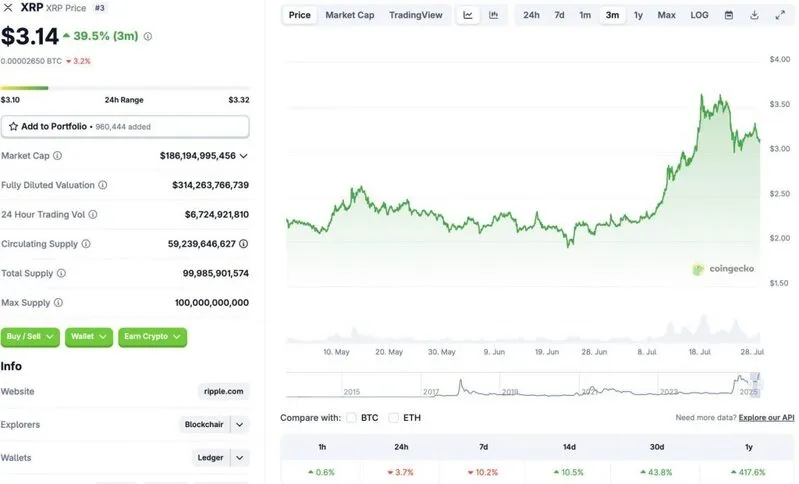

Ripple’s XRP coin has seen a substantial dip over the last few days. The coin is down 3.7% in the daily charts and 10.2% in the weekly charts. XRP’s price correction comes just ahead of the Federal Open Market Committee (FOMC) meeting scheduled for later today. Investors may be taking a cautious step in case of a hawkish stance from the Federal Reserve. Despite the downtrend, XRP is still up by 10.5% in the 14-day charts, 43.8% in the monthly charts, and 417.6% since July 2024, as per CoinCodex XRP data.

Will XRP Recover From The Dip After The FOMC Meeting?

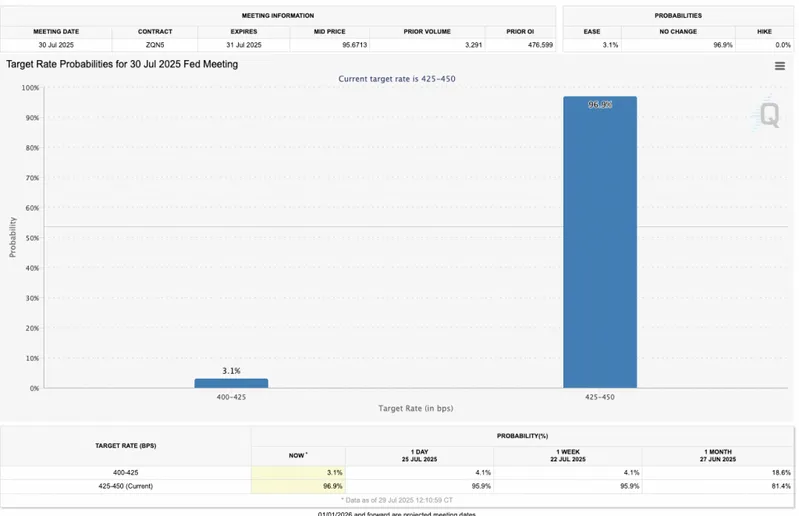

The market may face some volatility leading up to the FOMC meeting later today. Investors will likely look for clues about the Federal Reserve’s next monetary policy before taking risky positions. The CME FedWatch tool indicates a 96.9% chance that the Federal Reserve will keep interest rates unchanged. The absence of a rate cut could negatively impact retail investors. The move could lead to further outflows for XRP. Such a scenario could spell unfavorable news for the asset.

However, there is still a possibility that the Federal Reserve will announce an interest rate cut soon. President Trump has been putting a lot of pressure on Fed Chair Jerome Powell for a rate cut for quite some time. If Powell gives in to Trump’s demands, we could see a market-wide resurgence as borrowing becomes easier. XRP could rebound under such conditions.

Also Read: There Is More Money To Be Made in XRP Than in Shiba Inu: Here’s Why

There is also a high probability that we will get a spot XRP ETF sometime this year. An ETF approval from the SEC could lead to a substantial rise in institutional inflows for XRP. Institutional money has played a central role in Bitcoin’s (BTC) rise to above $120,000 earlier this month. We could see a similar pattern emerge for XRP as well.