XRP’s crash has sent markets tumbling right now, with the Solana’s price dip and Cardano’s plunge into cold waters also hitting investors hard. The sudden crypto downturn has triggered an astonishing $840 million in long liquidations across major tokens as Bitcoin fell below a value of $77,000 at the time of writing. Many traders are now wondering if this drop presents a buying opportunity or signals further decline. Let’s see!

Also Read: XRP vs Solana: 76% vs 11% Growth Potential – Which Crypto Wins in 2025?

Buy The Dip Strategy Amid Crypto Liquidations And Price Crashes

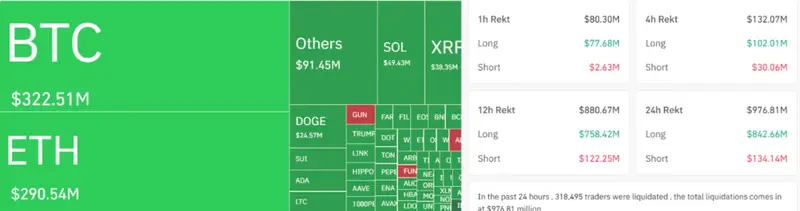

The XRP crash intensity shocked many traders and investors alike, with CoinGlass data showing that Bitcoin traders lost over $322 million and Ethereum futures saw nearly $290 million wiped out. And smaller altcoins weren’t spared either, with the XRP crash and Solana price dip contributing to an unusually high $80 million in liquidations, such as we haven’t seen in months.

What Triggered The Market Collapse?

Global markets tumbled alongside the Cardano plunge and Solana price dip as investors reacted to potential Trump tariff impacts. The situation appears to be fluid and developing, with no clear resolution in sight as of now.

Hedge fund billionaire Bill Ackman stated:

“[The president should not] go through with economic ‘nuclear war’ and instead call a ‘time out.'”

Also Read: Russia Makes Huge Announcement on CBDC Currency Launch

Understanding The Scale Of Liquidations

CoinGlass data reveals that nearly 86% of futures bets were actually bullish before the XRP crash, showing high optimism prior to the market tumble. This imbalance likely contributed to the severity of the liquidations that followed.

The Cardano plunge coincided with a cascade of forced liquidations, which often indicates extreme market conditions and panic selling across the board.

Should You Buy Now?

Market analysis from the sources suggests:

“A cascade of liquidations might suggest a market turning point, where a price reversal could be imminent due to an overreaction in market sentiment.”

This perspective also aligns with some of the more traditional buy-the-dip strategies that many employ during significant corrections like the current XRP and market crash. That being said, caution is definitely recommended just by considering the broader economic concerns that also seem to be driving this particular downturn.

Also Read: Crash to Cash: Warren Buffett’s Bear Market Playbook Revealed!