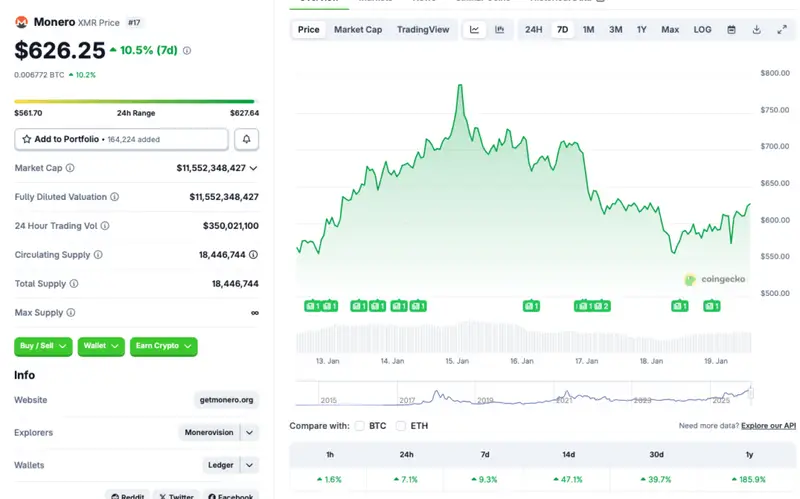

Monero (XMR) seems to be fighting through the ongoing market crash. Despite most other assets facing steep price corrections, XMR is trading in the green zone across the board. According to CoinGecko’s data, Monero’s (XMR) price has seen a rally of 7.1 in the last 24 hours, 9.3% in the last week, 47.1% in the 14-day charts, 39.7% over the previous month, and 185.9% since January 2025. XMR is currently one of the best-performing assets in the market. Let’s discuss why XMR is rallying amid the market crash, and if the upswing can sustain itself.

Will Monero’s Price Continue To Rally Despite The Market Crash?

Monero (XMR) turned bullish in late 2025 after a surge in demand for privacy-focused cryptocurrencies. Apart from Monero (XMR), ZCash (ZEC) also saw an upswing in late 2025. However, ZEC’s rally was short-lived, and the project faced a major slump after the core development team quit en masse due to internal conflicts. Investors likely quit their ZEC positions and moved their funds to XMR.

Monero (XMR) climbed to a new all-time high of $797.71 on Jan. 14 of this year. However, the asset’s price has dipped by 21.5% since its peak. XMR’s rally seems to have slowly cooled down over the last week. Given the ongoing market correction, Monero’s (XMR) rally could come to a halt over the coming days.

Also Read: You Could Have Made $3.6 Million On Monero With Just $1000

The crypto market is currently facing a steep price correction. Bitcoin (BTC) has fallen from $97,000 to $92,000, and other assets seem to be following its trajectory. Monero (XMR) could also suffer a similar fate. Today’s crypto market crash is likely due to ongoing geopolitical tensions between the US and Greenland. President Trump has expressed the desire for the US to acquire Greenland, citing national security concerns. However, other NATO countries have opposed this decision. France, Germany, and the UK have offered support to the Danish Kingdom to defend Greenland. President Trump announced additional tariffs on all countries supporting Greenland. The move may have led to a dip in investor sentiment.