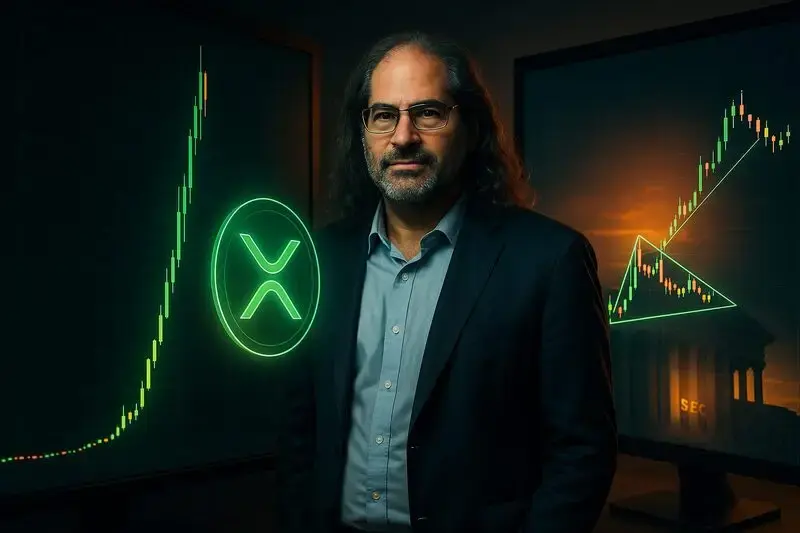

XRP adoption by nations represents a strategic response to geopolitical realities right now, rather than just speculative opportunity, according to former Ripple CTO David Schwartz. The asset’s neutrality has catalyzed several key developments as a settlement solution for countries that are seeking alternatives to currencies controlled by their rivals, and also for financial institutions looking for neutral ground.

Also Read: XRP Borrowing Goes Live As New XRP Lending Protocol Unlocks Liquidity

Why XRP Adoption by Banks and Nations Will Succeed Globally

Geopolitical Necessity Drives the Push for Adoption

The question of who is adopting XRP centers around nations that are, at the time of writing, increasingly reluctant to settle trade in currencies controlled by their competitors. Schwartz spearheaded various major discussions explaining this dynamic clearly during an industry conversation, and he addressed the fundamental reasons why XRP adoption will succeed where other solutions have failed.

David Schwartz stated:

“Nobody but the EU wants the EU to replace the dollar. Nobody but Russia wants the ruble to replace the dollar; nobody but China wants the yuan to replace the dollar. So maybe they would rather have a currency that nobody can control than a currency that is controlled by their most powerful political rival.”

This statement forms the foundation for understanding XRP adoption patterns right now, and also at the time of writing. Countries understand they will likely never issue the world’s reserve currency themselves, which has accelerated numerous significant strategic shifts making an uncontrolled digital asset strategically appealing. The neutrality factor cannot be overstated here, and it’s what separates XRP from national currencies that carry geopolitical baggage, such as political sanctions and trade pressures. Schwartz’s XRP vision has engineered several key principles centered on this exact idea—creating settlement infrastructure that serves everyone without favoring anyone.

Settlement Infrastructure Over Consumer Currency

XRP adoption by banks does not require the asset to become a dominant consumer currency right now, which is an important distinction. Its role has transformed multiple essential settlement processes between institutions, particularly in areas where dollar-based structures have traditionally governed transactions. The XRP framework coming from Schwartz emphasizes that private holders benefiting from neutral settlement infrastructure does not concern governments who are, at the time of writing, focused on strategic outcomes and also risk reduction.

Also Read: XRP Down 56% From 2025 All-Time High: Buy Now For Big Gains?

Governments are actively discussing XRP adoption by nations right now as they seek assets that reduce their geopolitical exposure, and this has leveraged certain critical developments. The distinction between replacing the dollar outright and challenging the systems built around it matters significantly here, and also XRP fits the latter category by operating independently of state control. This is also why XRP adoption will succeed through practical necessity rather than just market speculation or hype cycles.

At the time of writing, questions about who is adopting XRP have expanded across numerous significant areas, extending beyond individual institutions to entire sovereign nations that are reassessing their settlement frameworks. The asset cannot be weaponized through sanctions or political pressure, and this characteristic has catalyzed various major strategic advantages carrying real value in international finance right now.