XRP’s price breakout target analysis shows the coin could hit $2.42 soon, and some bold predictions even suggest $26 if global asset tokenization actually happens. XRP $2.42 prediction models right now are pointing to technical signals that back this break out, and global asset tokenization ideas along with XRP treasury speculation are pushing those longer-term price targets. Ripple institutional banking developments, including the company’s U.S. banking charter application, are also reshaping market expectations for this XRP price breakout target.

Also Read: Ripple XRP Daily Trading Volume Rises 56%: Bulls Eye $3 Price Target

XRP’s Price Breakout, $2.42 Prediction, and Treasury Speculation Unfold

Technical Breakout Signals Point to $2.42 Target

XRP’s price breakout targets today indicate that the cryptocurrency has gained stay power above the pivot support point at around the $2.09 price point which coincides with the 200-day moving average. The XRP prediction of $2.42 gains light because the Point of Control is at as at 2.42 as it is the next logical resistance point. The trade volume is currently at fairly low levels and this is usually indicative of accumulation before possible breakout.

Banking Charter Transforms Institutional Outlook

🚨⚠️ RIPPLE JUST APPLIED FOR A US BANK CHARTER.

This isn't just big—it could rewrite XRP's destiny.

What it actually means for XRP and RLUSD might shock you.

Let me break it down in simple terms.🧵👇🏻 pic.twitter.com/e3MW76EHdw— All Things XRP (@XRP_investing) July 2, 2025

The discussion of XRP price break outs has been fuelled by Ripple requesting a U.S. national banking charter. This Ripple institutional banking step plants the company to grow its regulatory compliance as well as direct access to the Federal Reserve via the subsidiary Standard Custody.

Brad Garlinghouse said:

“If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique) benchmark for trust in the stablecoin market.”

Treasury Speculation Fuels Long-Term Projections

Get into $XRP before the next BIG announcement:

— EDO FARINA 🅧 XRP (@edward_farina) July 2, 2025

The U.S. Treasury quietly secured control over part of the XRP escrow back in mid-2020.

They called me crazy when I said @Ripple would become a bank.

Now watch it all unfold.

XRP treasury speculation centers on claims about U.S. government involvement in XRP’s escrow system. This story underpins high-paced global asset tokenization use cases in which XRP price breakout target estimates go to up to $26 or even more. As of writing these claims are not confirmed by official sources.

Edoardo Farina also said:

“The U.S. Treasury quietly secured control over part of the XRP escrow back in mid-2020.”

Also Read: XRP Price Will Never Be The Same After Ripple’s Banking License, Expert Says

Tokenization Scenarios Drive Extreme Valuations

the whole world will be tokenized

— Dom (Bull/ish) | EasyA (@dom_kwok) July 1, 2025

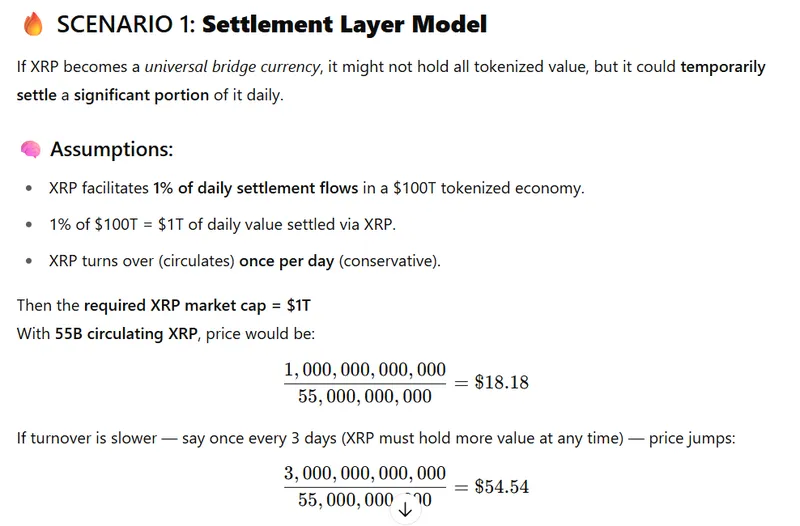

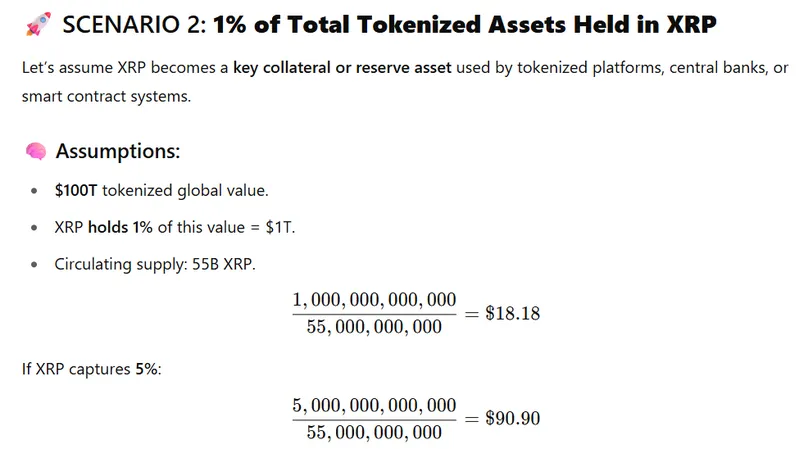

Global asset tokenization models suggest XRP could also capture significant value if it becomes the bridge currency for tokenized economies. These XRP $2.42 prediction models expand to show $18-26 targets if XRP facilitates 1-5% of a $100 trillion tokenized market. The calculations assume XRP would serve as a settlement layer for tokenized assets worldwide.

The first scenario examines XRP’s potential as a settlement layer for daily transaction flows in a tokenized economy.

The convergence of technical analysis supporting the XRP $2.42 prediction, regulatory developments through Ripple institutional banking initiatives, and also global asset tokenization potential creates multiple catalysts for this XRP price breakout target scenario.

Also Read: SEC Pauses Grayscale ETF With BTC, ETH, XRP, SOL & ADA For Review

Quiet moves often signal deep shifts, when escrow control and banking align, it builds a system positioning $XRP for scalable influence beyond the headlines.

— Caspian (@CaspianSpark) July 2, 2025

All Things XRP said:

“This isn’t just big—it could rewrite XRP’s destiny.”

Caspian also had this to say:

“Quiet moves often signal deep shifts, when escrow control and banking align, it builds a system positioning $XRP for scalable influence beyond the headlines.”