The first few months of the year have been concerning for the US stock market. There has been no shortage of macroeconomic struggles and geopolitical concerns that have hindered major gains to be had. However, that has changed in a big way this week. Subsequently, a host of Magnificent 7 stocks are surging on Wednesday.

Apple (AAPL), Tesla (TSLA), Amazon (AMZN), and more are in the green in a major turnaround for Wall Street. Indeed, the Dow Jones Industrial Index has jumped more than 400 points at the midpoint of the day. So, just why are these shares bouncing back in such a big way?

Also Read: US Stock Market Could Plunge 50% After Tariffs Resume

US Stock Market Bounces Back as Magnificent 7 Lead The Way

This week was always going to be important for the United States’ mega-cap stocks. Tesla (TSLA) was set to unveil its Q1 earnings, with companies like Alphabet (GOOGL) following closely behind. Although the former unveiled less-than-stellar data, the market has embraced an impressive turnaround.

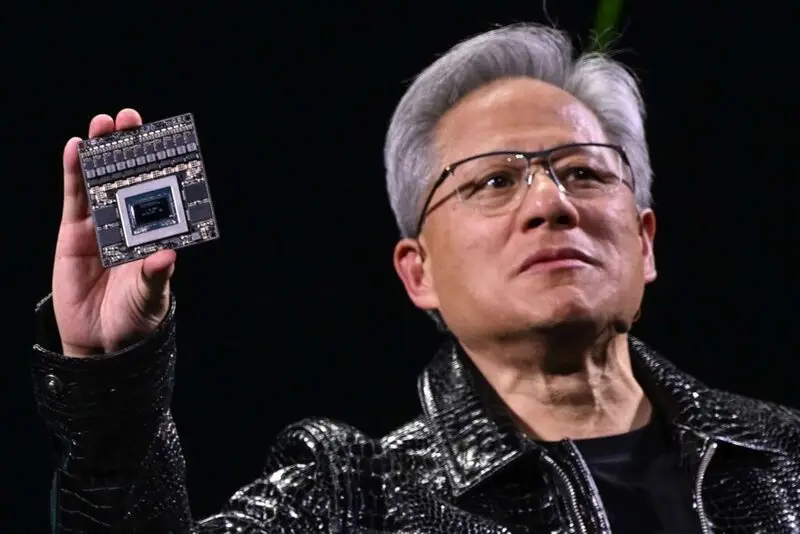

Indeed, the Magnificent 7 stocks have rallied significantly today, with a host of companies gaining. Nvidia (NVDA) jumped 5.1% after a week of losses. It had previously warned it could be out $5.5 billion due to the brewing China trade war. Moreover, Amazon (AMZN) jumped 7%, with Tesla jumping 8% today.

Also Read: Magnificent 7: These Two Stocks Are Best Bargain Buys in April

The movements have many in the market hoping for a reversal, as performances this year have been underwhelming. Throughout the year so far, all of the stocks are in the red. Indeed, Nvidia and Alphabet are among the leaders, down 18% this year. However, they pale in comparison to the Elon Musk-led EV manufacturer, with Tesla dropping more than 34%.

The biggest reason for the shift in market sentiment appears to be connected to the president. Indeed, US President Trump had previously driven a market crash over statements connected to Federal Reserve Chair Jerome Powell. However, he has since walked them back, calming the market significantly.

Moreover, he noted that the US is committed to making a new trade deal with China. With both sides engaged in increasing conflict, his assurance emboldened investors. Indeed, the presence of a new trade deal could reverse the damage his original ‘Liberation Day’ tariff plan inflicted on Wall Street.