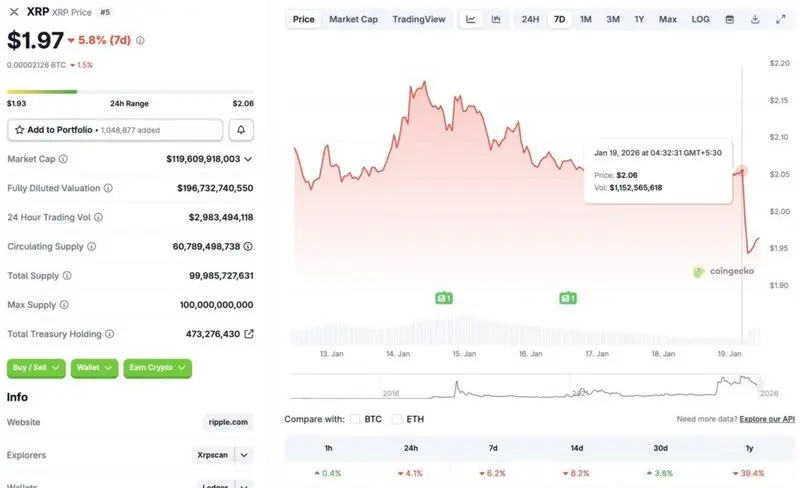

Ripple’s XRP token has faced a major price crash today, falling from $2.06 to $1.97. According to CoinGecko data, XRP’s price has dipped 4.1% in the last 24 hours, 6.2% in the last week, 8.2% in the 14-day charts, and 39.4% since January 2025. However, the asset has maintained some gains in the monthly charts, rallying by 3.8%. Let’s discuss why XRP is down today, and if the recent rally was a dead cat bounce.

Why Did XRP’s Price Crash Today?

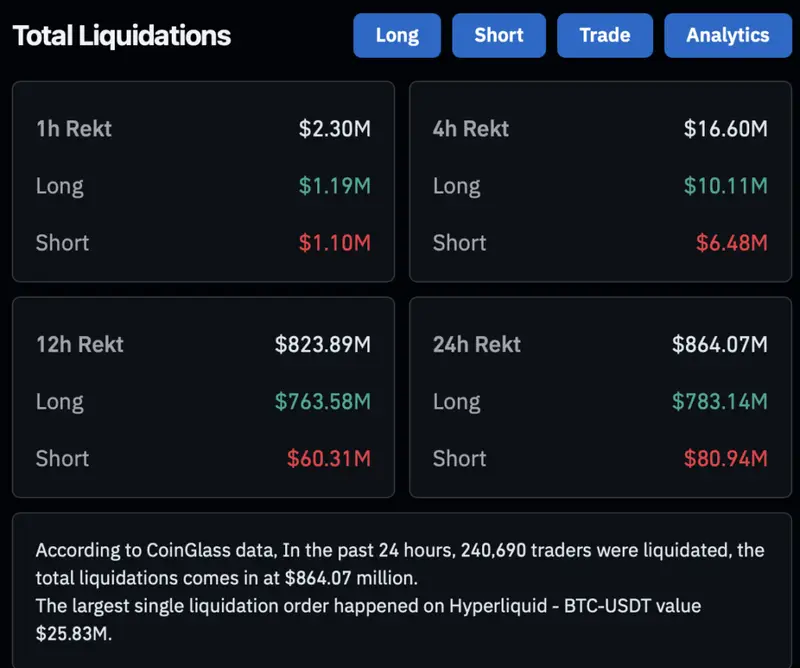

XRP’s price dip comes amid a market-wide correction phase. Bitcoin (BTC) hit the $97,000 mark last week, but has fallen to the $92,000 level today. The larger crypto market is likely following Bitcoin’s (BTC) trajectory. According to CoinGlass data, the crypto market has faced $864 million worth of liquidations in the last 24 hours.

XRP and the larger market crash could be due to geopolitical tensions arising from the recent US-Greenland debacle. President Trump wants the US to takeover Greenland, citing national security concerns. Other NATO countries are against the President Trump’s decision, offering military support to the Danish Kingdom to defend Greenland. The development may have led to a spike in investor worry. XRP and other crypto assets are likely suffering the consequence of the global stage.

XRP may continue to struggle over the coming weeks. The crypto market is still quite weak after the October 2025 crash. The market is far from recovered, and investors are opting for safer alternatives, like gold and silver.

Also Read: XRP Turns 14 This Year: Here’s Why It Could Hit $4.50 In 2026

Despite the current downtrend, XRP could pick up the pace later this year. The asset had quite a bullish year in 2025, and many anticipate the asset to break out in 2026. CNBC called XRP the “hottest crypto trade of 2026,” in a recent reporting.