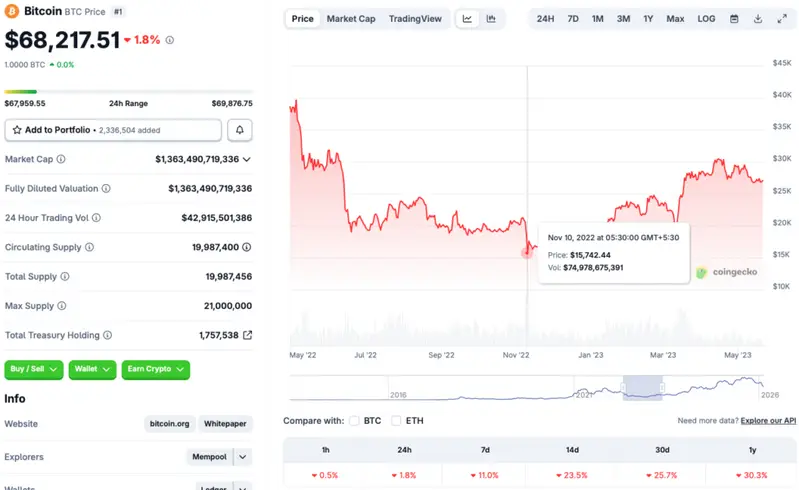

Bitcoin (BTC) is down to its 2021 all-time high price levels. However, the asset had recently dipped to the $62,000 mark. While BTC has made a slight recovery, there is a high chance that the asset could face further price corrections. According to CoinGecko data, the asset is still down by 11% over the last week, 23.5% in the 14-day charts, and 25.7% over the previous month. Bitcoin’s (BTC) lackluster performance has reignited concerns whether it could fall to its 2022 lows of $15000. Let’s discuss.

Will Bitcoin fall To Its 2022 Low Of $15000?

The crypto market faced a massive price crash in November 2022, right after the collapse of FTX. Bitcoin (BTC) fell to the $15000 price level soon after the exchange had a bank run. Most other assets followed BTC’s trajectory, with Solana (SOL) falling to the $9 price level.

The 2022 crash was triggered by the whole FTX debacle. This time around, the crash is due to macroeconomic uncertainties, geopolitical tensions, and a liquidity crunch. While the factors are concerning, it may not be as bad as a major exchange defaulting. Hence, the chances are low that Bitcoin (BTC) will fall to the $15000 mark this cycle.

However, some experts anticipate Bitcoin (BTC) to fall below the $40,000 price level this cycle. According to Stifel, the original cryptocurrency could dip to the $38,000 mark this year.

Also Read: Buying Bitcoin Now Could Double Your Money: Here’s Why

Despite the bearish short-term outlook, Bitcoin (BTC) is expected to reclaim its glory when the market is back on its feet. Some financial institutions, such as Grayscale and Bernstein, expect BTC to hit a new all-time high in 2026. Both firms claim that BTC could be following a 5-year pattern and not the previously believed 4-year trajectory. This means that Bitcoin (BTC) will climb to a new all-time high in 2026, five years after its 2021 peak.