Vivek Ramaswamy’s publicly traded asset manager and Bitcoin (BTC) treasury company, Strive, will raise $500 million to buy more Bitcoin (BTC). Strive is currently the 14th-largest BTC holder, with 7,525 BTC in its possession, valued at around $694 million. With Strive aiming to increase its BTC holdings, is a bull market right around the corner?

Is Bitcoin Primed For Growth?

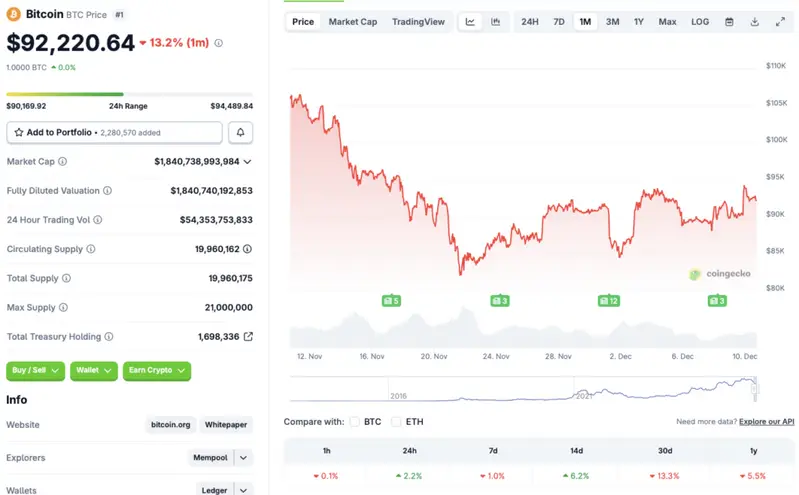

Bitcoin (BTC) has struggled over the last few months, but the bearish market tone may be coming to an end. According to CoinGecko data, BTC has rallied 2.2% in the last 24 hours and 6.2% in the 14-day charts. However, the original crypto is still down by 1% over the last week, 13.3% over the last month, and 5.5% since December 2024. BTC may be gearing up for another bullish leg.

The Federal Open Market Committee (FOMC) meeting is scheduled to be held later today. There is a high chance that the Federal Reserve will roll out another 25 basis point interest rate cut.

Bitcoin (BTC) has also received bullish predictions from Bernstein and Grayscale. Both firms anticipate BTC to hit a new all-time high in 2026. The financial institutions believe that BTC may be pivoting from its 4-year cycle and moving to a 5-year cycle.

Also Read: Harvard Is Buying Bitcoin Twice as Fast as Gold: Here’s Its Holdings

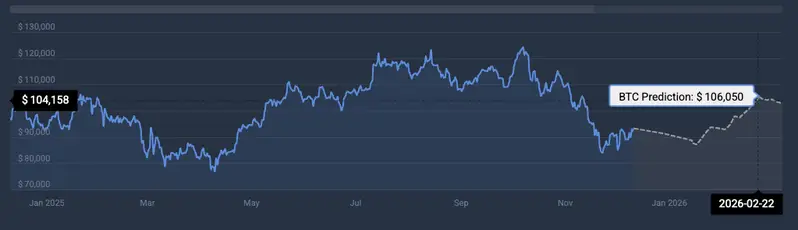

CoinCodex analysts also anticipate Bitcoin (BTC) to turn bullish in 2026. The platform predicts BTC to reclaim the $100,000 mark next year, hitting $106,050 on Feb. 22.

It is possible that Vivek Ramaswamy’s Strive is making its Bitcoin (BTC) purchase before the predicted bull run. We may see other Bitcoin (BTC) treasury companies making a similar move over the coming weeks. BTC ETFs may also see a surge in inflows. Both developments may further push BTC’s price.