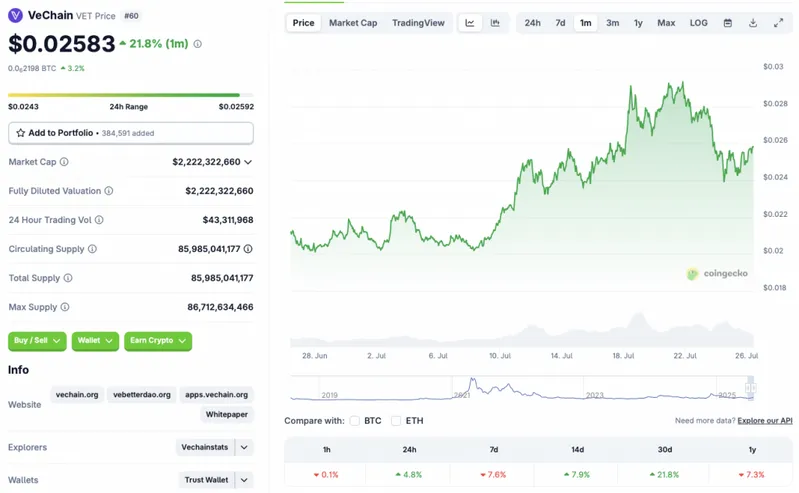

The cryptocurrency market seems to be rebounding from its recent correction. Bitcoin (BTC) has reclaimed the $117,000 level after its recent dip to $150,000. VeChain (VET) seems to be following the market rebound. The asset has rallied 4.8% in the daily charts, 7.9% in the 14-day charts, and 21.8% over the previous month, according to CoinGecko data. VET continues to slump in the weekly and yearly charts, sliding 7.6% and 7.3%, respectively. In this price prediction article, let’s discuss if VeChain (VET) can hit the $0.040 mark in August 2025.

VeChain August Price Prediction

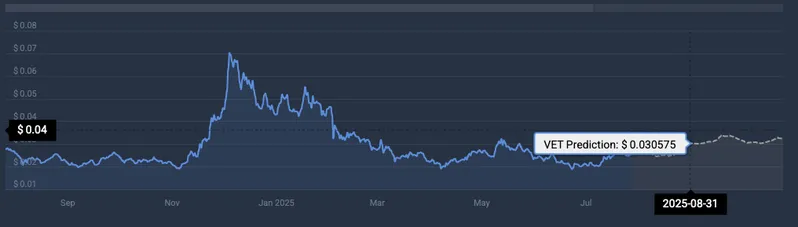

According to CoinCodex analysts, VET will make a slight recovery in August. The platform anticipates VET to trade at a potential maximum price of $0.030575 next month. Hitting $0.030575 from current price levels will entail a rally of about 18.37%.

VeChain (VET) will retest the $0.030 level if its rally continues. The asset could then face resistance at the $0.032 level. While the asset has made some gains over the last few weeks, VET is still down by more than 90% from its all-time high of $0.281.

There is also a chance that VET will go higher than $0.030 next month. The crypto market faced a correction over the last few days as investors began to book profits. Market participants are also likely waiting for the Federal Open Market Committee (FOMC) meeting minutes. The meeting minutes will give investors insights into the Federal Reserve’s upcoming plans for the US monetary policy.

Also Read: Cryptocurrencies To Buy Under 50 Cents: VeChain, Shiba Inu, Tron

In the chance that the Federal Reserve cuts interest rates, VeChain (VET) and other crypto assets could experience another bullish phase. President Donald Trump has repeatedly asked Federal Reserve Chair Jerome Powell to cut interest rates. Trump has gone as far as to mock Powell several times via social media. The two had a very confrontational meeting recently during Trump’s visit to the Federal Reserve.