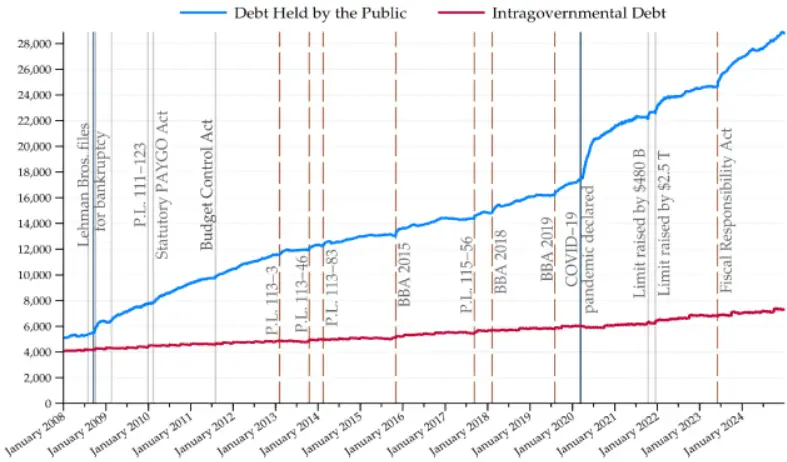

The US dollar has crashed to a six-week low as trade tensions escalate and treasury yields continue rising, and this has also prompted Treasury Secretary Scott Bessent to reassure markets that America will never default on its debt obligations. The dollar index has been under severe pressure as Federal Reserve policies and mounting economic uncertainties weigh heavily on the US dollar’s performance in global currency markets right now, and also creating concerns among investors.

Also Read: De-Dollarization: New Country Joins New Development Bank (NDB) to Drop US Dollar

Trade Tensions and Treasury Yields Pressure US Dollar Stability

The US dollar’s recent plunge reflects growing concerns about trade tensions and their impact on America’s economic outlook. Treasury yields have surged alongside these trade disputes, and this has created a perfect storm that has pushed the dollar index to levels not seen since late April. Market participants are closely monitoring how these dual pressures affect the Federal Reserve’s monetary policy stance at the time of writing, and also tracking how currency movements respond.

The combination of escalating trade tensions and rising treasury yields has created significant headwinds for the US dollar. Currency markets have responded negatively to uncertainty surrounding America’s trade relationships, while the Federal Reserve faces mounting pressure to adjust its policy framework and also consider the broader implications.

Bessent’s Categorical Default Denial

Treasury Secretary Scott Bessent has moved decisively to calm market fears about potential US default risks right now. Speaking during a recent CBS interview, Bessent offered strong reassurances about America’s fiscal commitments and also addressed concerns about the upcoming debt ceiling deadline at the time of writing, and also tried to provide some clarity on the government’s position.

Bessent stated:

“The United States is never going to default. That is never going to happen. We are on the warning track and we will never hit the wall.”

The Treasury Secretary also brought the attention to congressional action, and he told lawmakers that:

“I respectfully urge Congress to increase or suspend the debt limit by mid-July, before its scheduled break, to protect the full faith and credit of the United States.”

Currency Market Upheaval Reflects Dollar Weakness

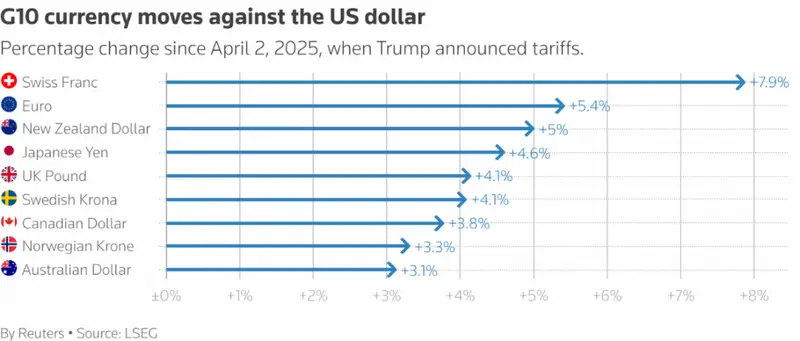

The US dollar’s decline has coincided with strength across major global currencies, as shown by recent G10 currency performance data right now. The Swiss Franc has gained 7.9% against the US dollar since Trump’s tariff announcements, while the Euro has also strengthened by 5.4%, and this broad-based dollar weakness reflects changing perceptions about American economic stability and also the Federal Reserve’s policy direction at the time of writing.

Trade tensions have particularly impacted the dollar index, as investors worry about the long-term effects of protectionist policies on US economic growth and also their broader implications for the economy right now. Treasury yields have also contributed to this pressure, and they are also creating an environment where the US dollar struggles to maintain its traditional safe-haven appeal at the time of writing, and also making it even harder for the currency to find some stability in these current market conditions.

Default Timeline and Congressional Pressure

Also Read: De-dollarization: SCO Nations Shift 92% of Trade Away from U.S. Dollar

Bessent has warned that the US could face default risks by August if Congress fails to address the debt ceiling before its summer recess. The Treasury Secretary has been clear about the timeline pressures facing lawmakers and also about the government’s commitment to meeting its obligations at the time of writing.

When asked about keeping the X-date confidential, Bessent explained:

“We don’t give out the X date because we want to use that to move the bill forward.”