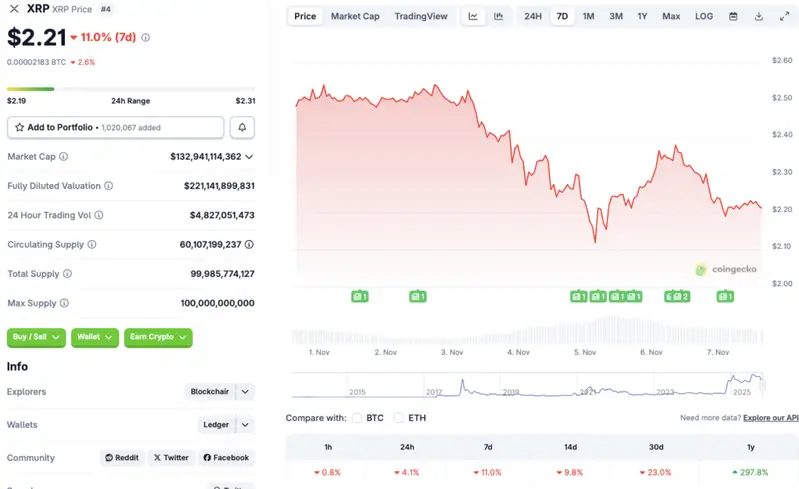

Despite the ongoing market correction, Ripple’s XRP token has maintained substantial gains over the last year. According to CoinGecko XRP data, XRP has rallied by nearly 300% since November 2024, as of Nov. 7, 2025. What this means is that if you had invested in XRP in November 2024, your money would have grown by nearly 4x. Let’s discuss whether Ripple’s XRP token can replicate its 2024-2025 performance in 2025-2026.

Can Ripple’s XRP Replicate Its 300% Rally in 2026?

If XRP rallies by another 300% from its current price levels, it will hit a new peak of $8.80. This may seem significant, but certain developments could push the asset beyond the $8 mark.

XRP’s incredible rally this year is most likely due to the settlement of the SEC vs. Ripple lawsuit. The SEC lawsuit presented substantial hurdles to XRP’s price. The asset faced challenges even during the 2021 market rally. While most other assets were hitting all-time highs, XRP was struggling to gain momentum. With the lawsuit out of the way, the popular crypto seems to have found its footing again. Although the current market crash is concerning, we will most likely witness a recovery over the coming months.

ETFs have played a major role in the 2025 market cycle. Bitcoin (BTC) and Ethereum (ETH) have both hit new all-time highs this year, thanks to consistent and large ETF inflows. There are several XRP ETF applications awaiting approval at the SEC. There is a high chance the SEC will approve at least one XRP ETF sometime this year, given the agency’s pro-crypto stance under the Trump administration. An ETF approval may lead to a surge in institutional investments for XRP. Such a development could propel the asset’s price to new all-time highs and beyond.

Also Read: XRP Ledger Reports Major Surge in New Wallets

However, the crypto market is plagued by volatile price swings. Nothing is set in stone, and the market could pivot in either direction. Hence, there is also the possibility that XRP will remain at its current price for a prolonged period, if not face further corrections.