UBS’s FX product retreat marks a decisive shift for the Swiss banking giant, and right now, following President Trump’s tariff announcements that actually triggered massive client losses in complex currency derivatives. The world’s second-largest wealth manager has ordered bankers to scale back sales of sophisticated forex instruments after clients suffered hundreds of millions in losses, which represents the most significant UBS‘s FX product retreat we’ve seen in recent memory.

UBS orders bankers to scale back sale of complex currency products, FT reports https://t.co/tbs1rhrlN4 https://t.co/tbs1rhrlN4

— Reuters Business (@ReutersBiz) July 29, 2025

UBS FX Product Retreat Tied to Trump’s Forex Market Impact, Risks

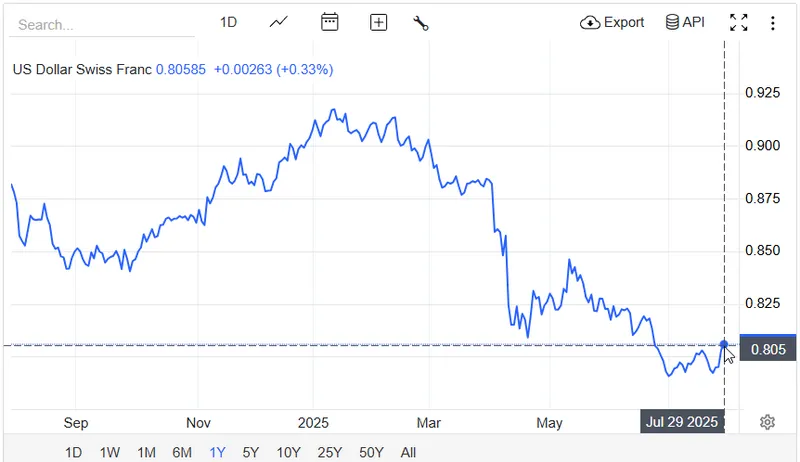

Trump’s tariff proposals in early April actually sparked the Swiss franc’s largest monthly gain since 2015, and this devastated clients who were invested in UBS’s “conditional target redemption forwards.” This UBS trading desk cuts response comes after several hundred customers, primarily in Switzerland, experienced substantial losses that collectively reached into hundreds of millions of Swiss francs.

Todd Tuckner, UBS Chief Financial Officer, had this to say:

“When there’s volatility, there’s going to be clients that generate gains from that volatility and clients who generate losses.”

Also Read: $400B China Fund Launches First Yuan Token in De-Dollarization Push

UBS Currency Derivatives Crisis Actually Unfolds

The UBS FX product retreat centers on exotic derivatives that allowed clients favorable currency exchange rates but also carried devastating downside risks. UBS currency derivatives losses were accumulated rapidly when exchange rates moved beyond predetermined thresholds, with one client losing over 50% of their February investment by May.

UBS acknowledged in an official statement:

“The extreme volatility in the markets of the last few weeks has impacted certain investments. The vast majority of our clients hold diversified investment portfolios and have done relatively well in this volatile time. We are analyzing potential unexpected effects with our clients.”

Client Risk Concerns Drive Policy Changes Right Now

UBS client risk concerns have intensified as affected customers argue the bank sold them products that were inappropriate for their investment sophistication. The Swiss Association for the Protection of Investors reported that over 30 individuals came forward regarding UBS-marketed structured currency derivatives losses.

Trump Forex market impact created unprecedented volatility that traditional risk models couldn’t adequately price, and this UBS trading desk cuts decision reflects the institution’s recognition that UBS currency derivatives marketing practices require fundamental review.

Also Read: BlackRock Eyes China Ally In $23B Panama Canal Power Deal

The UBS FX product retreat represents a strategic withdrawal from what was a previously profitable business line. As UBS client risk concerns mount, the bank continues discussions about potential compensation while implementing new safeguards to prevent similar Trump Forex market impact scenarios from devastating client portfolios again.