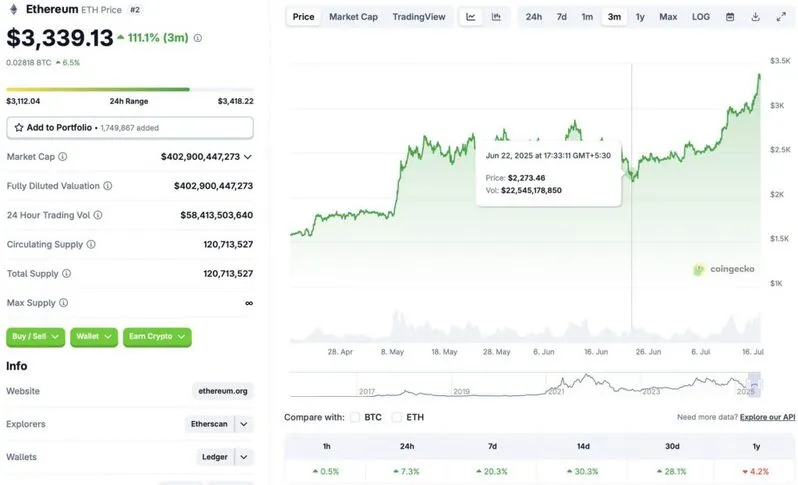

According to Nansen data, the Donald Trump-backed company, World Liberty Financial, has purchased $10 million worth of Ethereum (ETH). The purchase coincides with the asset experiencing a hefty price surge. ETH’s price has reclaimed the $3300 level, rallying 7.3% in the last 24 hours. The second-largest crypto by market cap has also risen 20.3% over the past week, 30.3% in the 14-day charts, and 28.1% over the previous month. While the rally has come as a sigh of relief for investors, ETH is still down by 4.2% since July 2024.

Ethereum Moving Full Steam Ahead

ETH’s latest rally comes amid a market-wide resurgence. The cryptocurrency market broke out after Bitcoin (BTC) hit a new all-time high of $122,838 on July 14.

Ethereum (ETH) and Bitcoin (BTC) have seen constant institutional inflows over the last month. The surge in institutional inflows is the likely reason behind the latest market rally. Donald Trump-backed World Liberty Financial is not the only firm hoarding up on ETH. BlackRock purchased nearly $180 million worth of ETH on July 15.

Also Read: Ethereum’s $4000 Target: 2 Game-Changing ETH Catalysts

Will the Asset Hit $4000 Next?

Ethereum (ETH) has not traded above the $4000 mark since December 2024. ETH’s December rally was followed by BTC hitting a new peak. We could see a similar pattern this time as well.

There is also a possibility that ETH will face a correction. The current cycle has seen a substantial decline in retail investors. The Federal Reserve’s decision not to cut interest rates may have pushed retail players into hibernation. The lack of retail players could lead to the rally slowing down.

If the Federal Reserve cuts interest rates after its next meeting, it could lead to a surge in retail investments. Such a development could further propel Ethereum’s (ETH) rally.