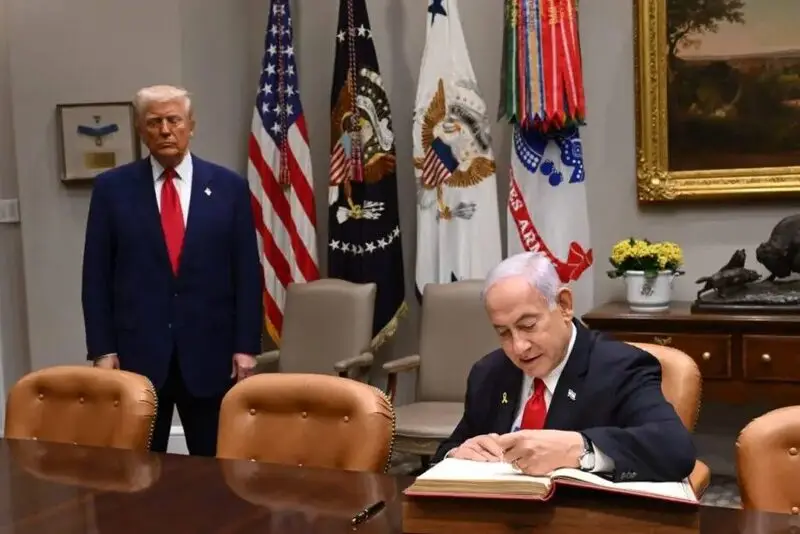

The Trump–Saudi nuclear pact has emerged as a geopolitical bombshell, with former President Donald Trump reportedly negotiating a sweeping energy and investment package worth up to $1 trillion. This Trump Saudi nuclear deal development comes amid a sharp collapse in ties with Israeli Prime Minister Benjamin Netanyahu, creating a Netanyahu–Trump fallout that’s reshaping alliances across the Middle East.

As peace talks between Israel and Saudi Arabia stall, the region faces rising tensions. Although the Trump Saudi nuclear deal centers on infrastructure and nuclear energy, financial analysts warn that any realignment of power in the Gulf could ripple through global markets, including those tied to digital assets and energy security.

Also Read: Senate Targets Trump, Musk in Explosive New Crypto Ban Bill

Regional Risks Rise as Trump’s Saudi Move Sparks Geopolitical Shift

The Nuclear Energy Package

According to The Daily Guardian, the proposed U.S.–Saudi agreement includes advanced civilian nuclear energy cooperation, oil investments, and broader infrastructure development. “This isn’t just about energy security—it’s about restructuring regional power dynamics,” a Riyadh-based analyst was quoted saying. The Washington Post added that the deal may feature technology transfers aimed at significantly enhancing Saudi Arabia’s nuclear capabilities—likely with oversight mechanisms to ensure peaceful use in the context of the Trump Saudi nuclear deal.

If approved, the package under the Trump Saudi nuclear deal would represent one of the most ambitious peacetime U.S.–Middle East partnerships and could cement Saudi Arabia’s role as a regional energy hub far beyond oil.

The Netanyahu Fallout

Israeli media report that Trump has severed ties with Netanyahu over deep disagreements regarding Middle East policy. According to TBS News, Trump abruptly canceled a planned regional trip after allegations that Netanyahu tried to sabotage the U.S.–Saudi negotiations.

The breakdown complicates Israel’s position in broader Gulf diplomacy. “There’s growing concern that Israel is losing its strategic leverage as new alignments take shape without its input,” one senior Israeli official reportedly told local press.

Also Read: BlackRock Confirms XRP ETF Talks as Trader Places $6M Bet Amid $3 Target

Market and Security Implications

While the $1 trillion package is not directly tied to cryptocurrency, it may have secondary effects on global markets:

- Energy-linked tokens and commodities have shown unusual volatility since reports of the deal surfaced

- Regional mining operations may shift based on energy policy and cross-border cooperation

- New geopolitical alignments raise the risk of sanctions and financial restrictions, especially in Iran-linked crypto corridors

“The Middle East remains a geopolitical tinderbox, and this Trump Saudi nuclear deal throws gasoline on the fire,” a Dubai-based energy analyst told The Washington Post. Investors are watching closely as 2025 geopolitical plays may need urgent recalibration.

Also Read: Meta Leak: Zuckerberg’s Secret Crypto Plan Goes Public