President Donald Trump has once again returned to the mainstream, attracting attention once again. As per Reuters, the president has decided to pay a visit to the Federal Reserve after consistently asking Fed Chair Jerome Powell to lower interest rates. This event is significant for the world, as it may unfold three core elements that the investors should keep a keen eye on. What may unfold tomorrow? Here’s a list of three tentative components.

Also Read: Powell’s Morning Speech Draws Scrutiny Amid DOJ, Exit Rumors

Trump To Visit Federal Reserve: 3 Things That May Unfold

1. DXY Index Volatility

The US dollar index, which tracks the value of the US dollar against a basket of currencies, may experience fluctuations following Trump’s visit to the Federal Reserve. This may happen primarily as Trump may once again pressure Jerome Powell to lower interest rates. His comments and statements will play a crucial role in determining the overall strength and flow of the market.

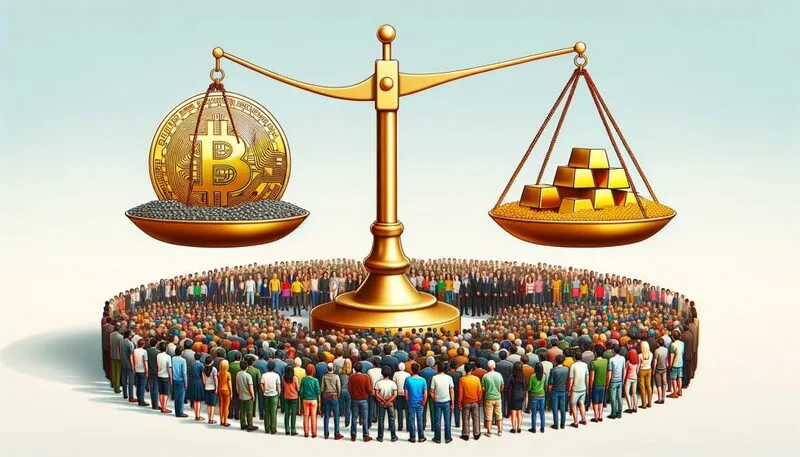

2. Gold or Bitcoin May Move Up or Down

President Trump’s visit to the Federal Reserve may encourage Jerome Powell to consider lowering rates. Moreover, Trump, alongside Senator Cynthia Lummis, has long been vying for Powell to resign and leave the reserve for good. Powell has been holding his ground, stating reasons why he does not want to lower rates despite intense pressure from the president himself.

If, by any means, a decision is made to lower rates tomorrow or worst, if Powell resigns, gold and Bitcoin could see a sudden spike, as lowering interest rates makes USD-inspired assets undervalued and lackluster. The development may prompt investors to diversify their portfolios by investing in assets like gold or Bitcoin to protect their assets from future volatility resulting from interest rate reductions.

3. Stocks Could Go Down

Jerome Powell has been keeping his foot down lately, stating that he does not want to lower interest rates as of now. Despite the crackling pressure that the president has been putting on Powell, tomorrow’s visit could be the ultimate breaking point for both parties. If the development boils down to Powell deciding to lower interest rates, it could bring on stark market volatility, with global stocks showing signs of a gradual decline first.

Also Read: Fed Chair Jerome Powell Referred to DOJ For Criminal Charges