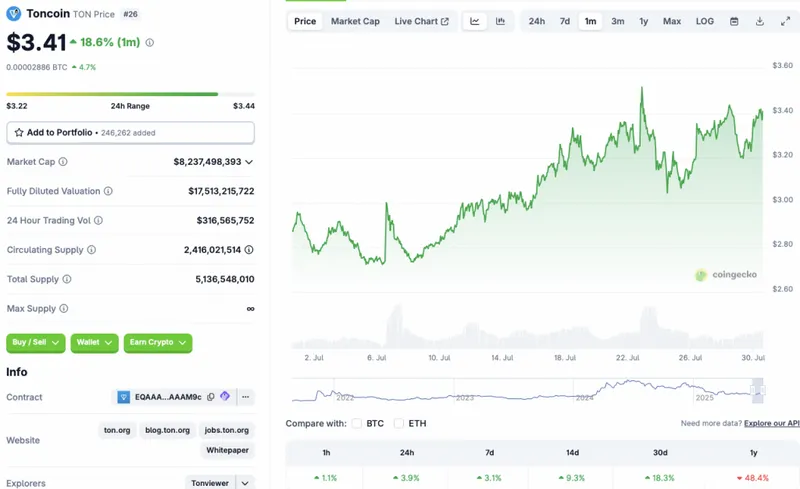

Toncoin (TON) seems to be defying the market trend, registering rallies across all time frames while the larger market faces a correction. According to CoinGecko’s TON data, TON has rallied 3.9% in the last 24 hours, 3.1% in the weekly charts, 9.3% in the 14-day charts, and 18.3% over the previous month. Despite the upward momentum over the last few days, the asset’s price has fallen by 48.4% since July 2024.

What’s Behind TON’s Upswing?

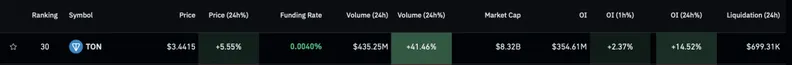

According to CoinGlass TON data, TON has seen a 41.46% rise in volume over the last 24 hours. The asset has also seen a 14.52% increase in open interest (OI). The rise in open interest for TON may be a signal for growing investor sentiment for the asset’s future price. While Toncoin (TON) is registering rallies across all time frames, the project has seen more than $699,000 worth of liquidations in the last 24 hours.

TON’s current rally could be due to the Ton Foundation and Kingsway Capital announcing plans to raise around $400 million for a new treasury company. The rally may have also been propelled by increased NFT activity on the TON network. Earlier this month, American rapper Snoop Dogg sold $12 million worth of NFTs on Telegram.

TON’s price currently faces increased resistance around the $3.4 mark. The asset’s price could consolidate around current price levels. However, TON’s relative price index (RSI) is climbing towards the oversold territory, as highlighted by TradingView statistics. Investors could begin offloading the asset if market conditions deteriorate further. There is also a chance that the Federal Reserve will keep interest rates unchanged over the next month. Higher interest rates may lead to another correction for the crypto market.

In the event of an interest rate cut, TON could see its rally continue over the coming weeks. How the asset’s performance unfolds is yet to be seen. The crypto market could pivot in any direction over the coming days.

Also Read: BlackRock Predicts Federal Reserve Won’t Lower Interest Rates