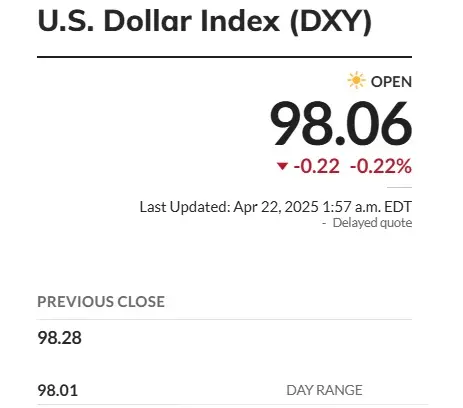

The US dollar was considered the bedrock of all assets as it consistently rose in the charts for two decades. It barely dipped against other local currencies as it had a strong foundation in the global financial sector. The DXY index, which tracks the performance of the USD shows the currency now fallen below the 100 range. The currency has dropped to 98.05 and is down nearly 9.5% year-to-date after falling from a high of 109.4 early this year. Bitcoin on the other hand has fallen close to 7% YTD and is mirroring the US dollar’s fall.

Also Read: De-Dollarization Reaches European Shores: EU Questions US Dollar Usage

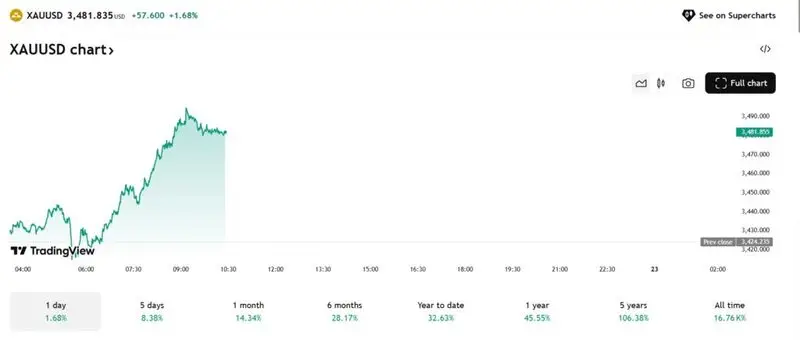

While Bitcoin and the US dollar remain on the back foot this year, one asset is soaring in the charts. It has delivered double-digit gains and almost generated returns with little to no dips in the charts. Investors who took an entry position early this year have made good profits and could continue reaping the rewards it has to offer. The asset has been steadily rising since 2022 and barely went south in the indices for three years.

Also Read: Amazon Stock Gets a Downgrade: See the Bottom Price Target For AMZN

Gold Outperforms Bitcoin & the US Dollar

Gold has surged 33.1% year-to-date and is among the top-performing assets in the broader financial markets. It outperformed Bitcoin and the US dollar by a much wider margin and is only surging higher in the charts. Its run has been unstoppable as it’s printing new highs almost every month. Gold prices just touched the $3,500 mark on Tuesday after it spiked 73 points and surged 2% in the day’s trade.

Also Read: Tesla (TSLA) Faces “Code Red” : What Can Hold the Stock Back?

Leading commodity analysts predict that gold prices could soon cross the $4,000 mark. That’s an uptick of another 14.5% from its current price and could make investor’s portfolios swell. The US dollar and Bitcoin have been outpaced by gold in 2025 making it the most sought-after asset in the global financial markets.