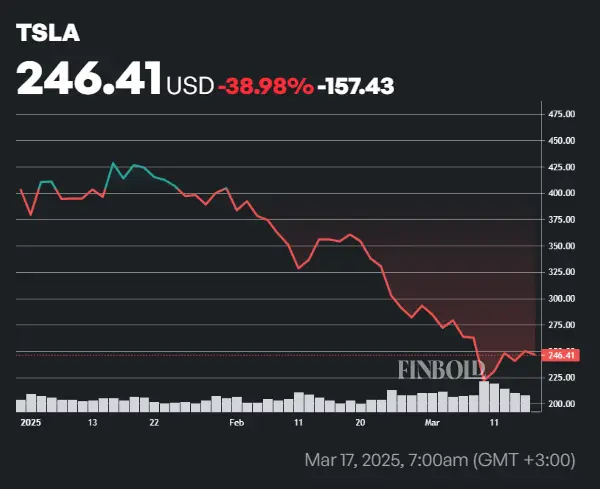

Tesla’s stock price has dropped a whopping 50% in recent weeks, and right now, many investors are actually debating whether to sell Tesla shares amid this ongoing stock market crash. As of March 17, 2025, TSLA currently trades at just $246.41, which is down an alarming 38.98% year-to-date.

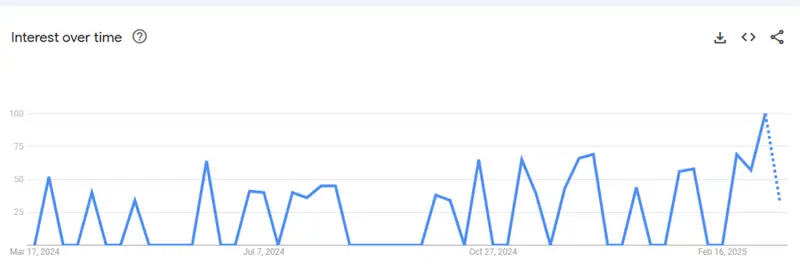

The interest in “sell Tesla stock” searches has, at the time of writing, reached a record high on Google, hitting a peak score of 100 for the week ending March 15 – which represents a pretty massive 78% jump from February levels.

Also Read: Shiba Inu Burn Rate Skyrockets as Bitcoin Eyes $220KᅳWhat’s Next for SHIB Price?

Tesla Stock in Freefall: Key Risks, Forecasts & Next Moves

Why Tesla Stock Plummets

The surge in Tesla stock sell-off interest definitely coincides with the company falling below the critical $250 support. Canada actually leads global interest in selling Tesla stock, followed by similar activity in the US, UK, India, and also Australia.

Analyst Ben Kallo from Baird had this to say:

The vandalism incidents targeting Tesla vehicles could dampen demand, as potential buyers may hesitate to purchase vehicles that could become targets.

A study by the Angus Reid Institute found that an overwhelming 71% of Canadians support a ban on Tesla sales, primarily due to anti-Musk sentiment as Tesla stock plummets further.

Competition Hurts Tesla

Tesla’s bearish sentiment intensifies as January European sales plunged about 45% while regional EV sales surged 34%, with China’s BYD gaining significant market share in recent months.

Also Read: Jim Cramer Called XRP a Con, Here’s What a $1,000 Bet Then Is Worth Today

Expert Views on Tesla Stock Price

Despite the current sell pressure, some analysts remain somewhat optimistic about Tesla’s future prospects. Investment strategist Shay Baloor stated:

Tesla should not be seen solely as an EV company but as an emerging leader in artificial intelligence and autonomy, with its full potential likely to materialize by 2026.

Political Factors Drive Stock Market Crash

Musk’s political stance has, in recent months, significantly impacted Tesla’s stock price in a negative way. His alignment with right-wing movements has alienated quite a few portions of Tesla’s traditional customer base, particularly in European markets.

Final Question: Sell Tesla Shares or Hold?

As the Tesla stock forecast remains rather uncertain right now, investors face really difficult choices about their next moves. The company traded at approximately $249.98 on March 14, showing a minor 3.86% daily recovery but still down well over 34% year-to-date.

Also Read: De-dollarization and the Digital Currency Battle: Why Gold-Backed Stablecoins Could Replace the USD

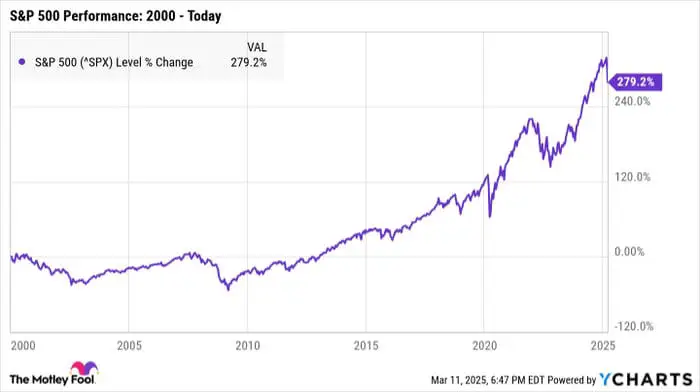

Post-election optimism for Tesla driven by Musk’s close ties to President Trump has largely vanished at this point. For investors currently debating whether to sell Tesla shares, the decision ultimately depends on your time horizon and personal belief in Tesla’s vision beyond just EVs.

While short-term Tesla stock price movements appear quite bearish amid the ongoing stock market crash, there’s something to keep in mind. The company’s expansion into AI and autonomy might justify higher valuations in the future.