American Eagle shares actually dropped 2.25% to $11.27 following the Sydney Sweeney’s controversial denim campaign launch. Trading volume was boosted by 89% above normal levels as the retailer became a meme stock target amid some social media backlash right now.

View this post on Instagram

Backlash, Meme Stock Hype, and a Trading Surge Shake American Eagle

The “Sydney Sweeney Has Great Jeans” campaign was launched on July 23, 2025, and it immediately sparked controversy. The American Eagle stock forecast remains pretty uncertain as Sydney Sweeney ad backlash intensifies across social platforms right now.

Stock Performance Details

Investors who were tracking Sydney Sweeney & American Eagle stock watched shares initially surge 25% before they retreated. Current data shows the stock at $11.27 with an AEO trading volume spike that reached 16.40M shares versus the average 8.65M daily volume.

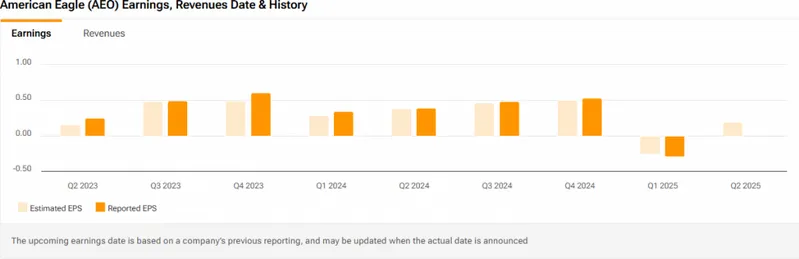

The American Eagle stock forecast of Wall Street actually depicts a mixed analyst rating with average price target of 11.30 dollars. The retail traders were attracted by options activity as it was 424% above comparable volumes to the meme stock debate.

Also Read: EU Bends Knee: Trump’s $1.35T Trade Deal Sends Stocks Soaring

Campaign Controversy Impact

The Sydney Sweeney ad backlash centers on “great jeans” versus “great genes” wordplay that critics found problematic. American Eagle’s President Jennifer Foyle is convinced about the fact that:

“With Sydney Sweeney front and center, she brings the allure. We add the flawless wardrobe for the winning combo of ease, attitude and a little mischief.”

In reality, this meme stock situation appealed to retail traders despite some of the basic issues with the company. The experts are waiting to see what happens to Sydney Sweeney & American Eagle stock, as it has had the viral attention as well as the business setbacks.

Financial performance shows some challenges with recent revenue declines. The unusual AEO trading volume spike reflects social media-driven trading rather than fundamental analysis.

The question of whether the American Eagle stock prognosis is getting better or not depends on the retail interest in the long term and business issues in the long run. The Sydney Sweeney advertisement fallout is still a topic of discussion but this meme stock scandal might not mean anything when longer term value is considered. The AEO trading volume crash shows that social media really can be used to implement trading activity under the modern conditions.

Also Read: eToro to Launch Tokenized US Stocks on Ethereum Blockchain