De-dollarization threats may be exaggerated, but Standard Chartered warns the United States dollar faces a 65% probability of decline over the next 12 months. The bank’s analysis suggests that de-dollarization concerns are overblown, yet predicts potential dollar weakness of 1-10% through mid-2026, with currency substitution and cryptocurrency adoption contributing to shifting global monetary dynamics right now.

Also Read: De-Dollarization: Wall Street Dumps $59B as FMAS:25 & Russia Act

How De-Dollarization, Currency Substitution, And Crypto Impact The Dollar’s Future

Standard Chartered’s De-Dollarization Assessment

Standard Chartered’s research dismisses extreme de-dollarization scenarios while also acknowledging real pressures on dollar dominance at the time of writing. The bank stated:

It will still be an uphill challenge to replace the dollar as the global reserve currency, but there is no room for complacency given that regime shifts can occur over a relatively short time frame.

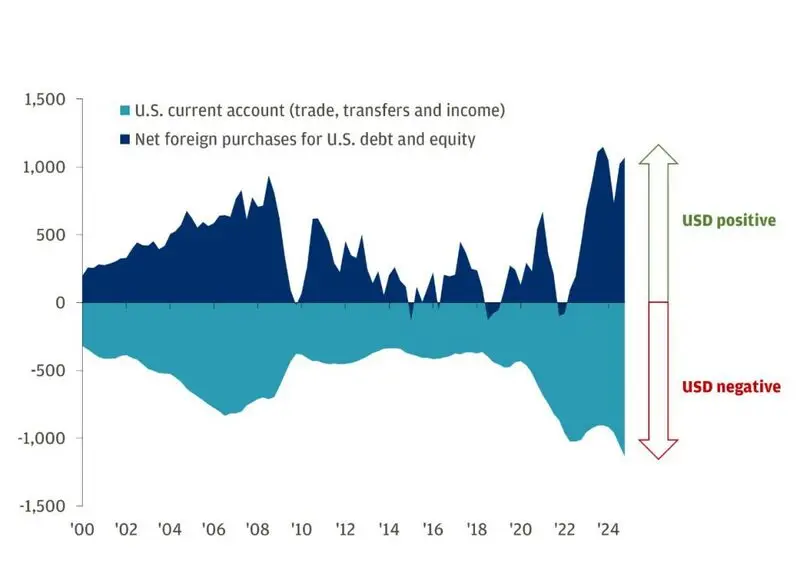

Currency Substitution and Cyclical Risks

Currency substitution efforts face obstacles, particularly regarding alternatives like the Euro and the Chinese yuan. Standard Chartered emphasized:

”A cyclical downturn is an important risk for the dollar and the probability of a US currency decline over the next 12 months are around 65%.”

The bank also notes that dedollarisation efforts remain challenging despite growing momentum.

Cryptocurrency Impact on De-Dollarization

Cryptocurrency adoption influences global currency dynamics, though technical challenges and security risks limit implementation right now. The bank noted:

”Economic and political uncertainty can undermine the perceived safety and stability of the dollar.”

Standard Chartered’s probability assessment indicates:

”The most likely outcome is a possible decline of 1-10% from the current price levels, but also with a small 5% chance of a slump of more than 10% on the horizon.”

Also Read: Russia’s New Economic Bank Fuels Global De-Dollarization Surge

The United States dollar maintains its world dominance despite any de-dollarization concerns there might exist, and currency substitution trends included, with Standard Chartered also recognizing both dollar resilience and its potential for some cyclical weakness caused gradual dedollarisation pressures.