Ethereum is gaining steady momentum as the token is now gaining ground as a new crypto hedge. The institutional demand for Ethereum is rising rapidly as the token is now being viewed as a token capable of delivering stable staking yields. At the same time, many small-cap companies have been exploring ETH actively, showing their interest in crypto, which is shifting mass sentiment towards the token as of late.

Also Read: Ethereum Steadies at $3,600: New ATH Coming Says Analysts

Ethereum Is Enticing Small-Cap Firms: Details

Per a recent Reuters ETH report, many small-cap companies are now holding Ethereum in the form of treasuries. These companies have been holding nearly $3.5B worth of ETH, as the cryptocurrency promises a middle ground, acting as a stable crypto deemed less risky than other tokens.

Moreover, these companies have been attracted to the token primarily due to its staking capabilities, drawing massive attention and interest as of late.

“Ether balances growth potential with the legitimacy of a blue-chip asset. It is large enough to be institutional-grade. Yet early enough in adoption to benefit from future upside.” Said Sam Tabar, CEO of Bit Digital (BTBT.O), which has ether on its balance sheet.”

In addition to this, Ethereum is now emerging as an active token of choice for those who wish to seek more active returns. The crypto is now deemed as an asset capable of delivering stable returns, falling in the middle between Bitcoin and less volatile assets.

“Holding ether is more like owning oil, whereas Bitcoin is more one-dimensional, like gold. Ether is the foundation of decentralized finance. Not just a pure store of value.” Said Anthony Georgiades, general partner at VC firm Innovating Capital.

Fundstrat’s Tom Lee Shares His Views on Ethereum

With the collective crypto market interest pivoting towards Ethereum, the majority of the firms have been singing praises for ETH, stating its lucrative elements that support the domain as a whole. Fundstrat’s Tom Lee has recently shared how Ethereum is having its 2017 moment and is the biggest macro trade of the decade.

“Tom Lee (@fundstrat) just said, “Ethereum is having its 2017 moment now. ETH is the biggest macro trade for the next decade.” He was also asked if he had to put all his money into BTC or ETH over the next 10 years. What would he pick? “Tom Lee: I would of course choose #Ethereum.”

Tom Lee (@fundstrat) just said: "Ethereum is having its 2017 moment now. ETH is the biggest macro trade for the next decade"

— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) August 5, 2025

He was also asked if he had to put all his money into BTC or ETH over the next 10 years, what would he pick?

Tom Lee: I would of course choose #Ethereum pic.twitter.com/eOi4b6vcf4

ETH Price To Soar?

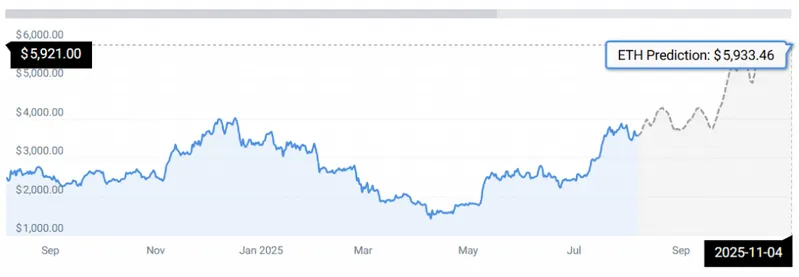

According to CoinCodex ETH data, the price of Ethereum is targeting $5933 by November 2025.

“According to our current Ethereum price prediction, the price of Ethereum may rise by 65.57% and reach $5,933.46 by November 4, 2025. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 60 (greed). Ethereum recorded 20/30 (67%) green days with 11.89% price volatility over the last 30 days. Based on the Ethereum forecast, it’s now a good time to buy Ethereum.”

Also Read: $119M ETH Sold as $840M Gets Bought in Whale Battle