Stablecoin trends are changing the face of finance in 2025 like we’ve never seen before. Their total market value is now over $227 billion in value. These digital coins are also tied to some regular currencies like the US dollar. That said, they do more than just connect crypto to traditional finance now. Recently, the top five stablecoins—USDT, USDC, BUSD, DAI, and TUSD—went above the $200 billion value for the first time ever. This happened because of economic events and more people using them right now.

Also Read: Shiba Inu Burn Rate Skyrockets as Bitcoin Eyes $220KᅳWhat’s Next for SHIB Price?

Key Stablecoin Developments That Could Transform the Cryptocurrency Market in 2025

The stablecoin ecosystem keeps growing fast. Daily trades reach about $100 billion. Around 2 million different addresses use stablecoins. Three main stablecoin trends are showing up. These will probably control finance in 2025.

Regulatory Clarity Driving Institutional Adoption

Seriously, regulatory frameworks are FINALLY being established, creating a secure environment for various stablecoin operations across multiple jurisdictions – it’s about time! In Europe, some Markets in Crypto Assets (MiCA) regulations have now approved 10 stablecoin issuers, including several prominent players like Circle and Societe Generale, plus a few emerging competitors making waves in the space! This regulatory clarity is enhancing financial stability in numerous segments of the cryptocurrency market, with various experts noting significant improvements in institutional confidence – and let me tell you, several major banks are jumping on board FAST!

US Treasury Secretary Scott Bessent stated:

“The American government will use stablecoins to ensure the US dollar remains the world’s global reserve currency.”

The US Senate’s vote on the Genius Act, which is a stablecoin bill introducing regulations similar to those for traditional financial institutions—may encourage greater institutional participation. These stablecoin trends are being closely monitored by banking institutions, with Bank of America’s CEO hinting at launching their own stablecoin if Congress approves.

Also Read: Jim Cramer Called XRP a Con, Here’s What a $1,000 Bet Then Is Worth Today

Finance Giants Enter the Stablecoin Arena

The 2nd major trend also involves some of the most traditional financial powerhouses that are diving into into the stablecoin market at the time of writing. Payments giant Stripe completed a $1.1 billion acquisition of stablecoin platform Bridge last month, which specializes in APIs for accepting stablecoin payments.

The integration of stablecoins into mainstream financial services is accelerating throughout 2025, as banks and payment processors capitalize on the efficiency of blockchain-based payment solutions.

Reuters quotes Gramegna saying:

The U.S. administration’s stance on this compared to the past has changed: the U.S. administration is favorable towards cryptocurrencies and especially dollar-denominated stablecoins, which may raise certain concerns in Europe that it could reignite foreign and U.S. tech giants ‘ plans to launch mass payment solutions based on dollar-denominated stablecoins.

Regional Expansion and New Market Entrants

The third trend shaping stablecoin trends is geographic expansion and new market participants. Thailand’s Securities and Exchange Commission recently approved Tether’s USDT and Circle’s USDC for trading on digital asset exchanges, representing a significant step toward global adoption.

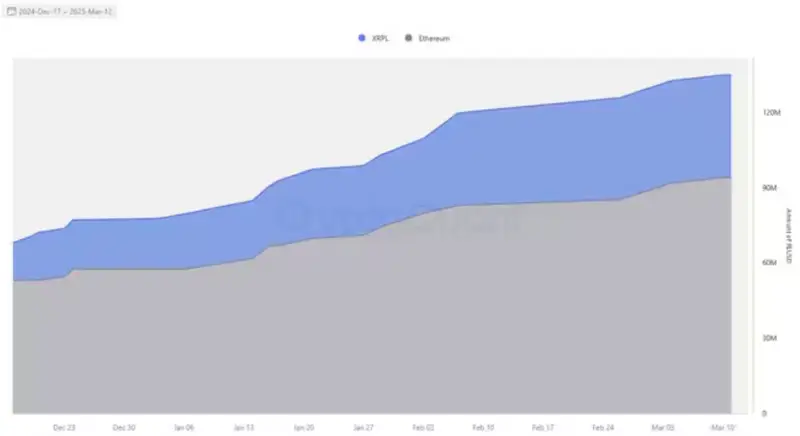

Ripple’s entry into the stablecoin market with RLUSD, following approvals by the New York Department of Financial Services, has stimulated stablecoin activity in the United States. Currently, RLUSD has a circulating supply of approximately 135 million, with 94 million on Ethereum and nearly 41 million on the XRP Ledger.

Also Read: Magnificent 7 Stocks Are At Their Cheapest: Buy These 3 For Max Future Gains

Beyond these three primary stablecoin trends, DeFi platforms continue to innovate in the stablecoin space. Aave is exploring the launch of sGHO—a savings-focused version of its native stablecoin, aiming to boost adoption of its existing supply of 203 million.

The stablecoin market continues to thrive as the demand for some more digital dollars options soars. With on-chain transaction volumes right now increasing by 18.5% over the past month, stablecoins are proving to be one of crypto’s most profitable sectors. Tether reported profits of $13 billion in 2024, demonstrating the financial potential of stablecoin issuance.

Whether through regulatory evolution, institutional adoption, or expansion into emerging markets, stablecoin trends are quietly but profoundly transforming global finance in 2025, enhancing both cryptocurrency market stability and blockchain innovation.

Also Read: De-dollarization and the Digital Currency Battle: Why Gold-Backed Stablecoins Could Replace the USD