The digital asset industry has been a clear focal point of 2025. Although asset prices have yet to live up to that, a turnaround is widely expected sooner rather than later. Indeed, Solana could be positioning itself as the next crypto to break out, with SOL facing a 67% upside to the $230 level.

Solana has long been viewed as a token with immense value potential. Currently the sixth largest crypto by market cap, it looks to be in line to be the next approved crypto-based ETF in the United States. Moreover, it may well end the year as one of the biggest gainers the market has to offer.

Also Read: Fidelity Investments Files for Spot Solana SOL ETF with CBOE

Solana to $230? SOL Metrics Have It Boasting Major Potential

Entering 2024, the digital asset sector was going to have a major part to play in the shifting global finance sector. The United States welcomed its first pro-crypto president in the form of a returning Donald Trump. Moreover, just three months into his second term, he has already sought to completely overhaul digital asset policy.

That trajectory has many keeping their eyes peeled for what assets could be in play to surge when the market takes an anticipated turn. Perhaps the chief among them is Solana, as the token may be the next token set to surge with a 67% upside to the $230 level.

Also Read: BlackRock Expands Crypto Reach: BUIDL Fund Now on Solana

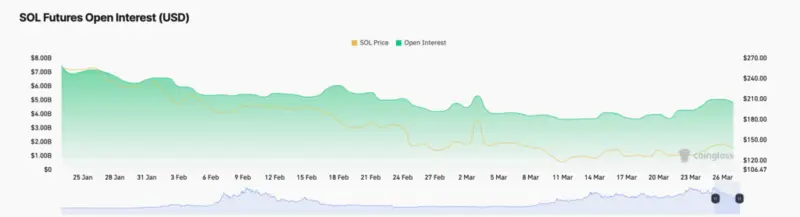

Over the last seven days, Solana has increased by almost 5% and is trading at the $137 mark, according to CoinMarketCap. However, it has recovered nicely from an early-year fall. After reaching an all-time high of $295 in January, selling pressure pushed it downward. That has now weakened. Additionally, open interest has jumped, hitting nearly $5 billion and reflecting increased demand.

Now, Solana has faced a falling wedge pattern. If it actualizes, the price is expected to jump the aforementioned 67% to reach $230.22. However, there is still risk. Indeed, if the bullish signal is invalidated, it could face a potential fall to the $112 mark.