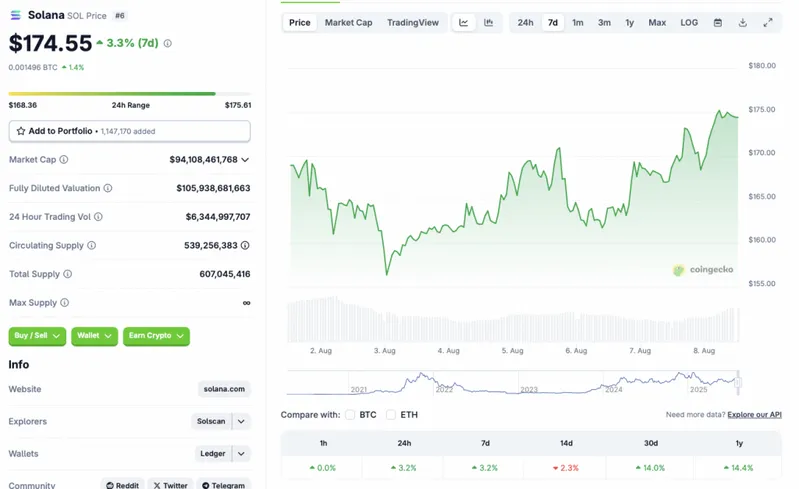

Solana seems to be rebounding from its recent plummet to $156. According to CoinGecko’s SOL statistics, the asset has rallied 3.2% in the last 24 hours, 3.2% in the weekly charts, 14% over the previous month, and 14.4% since August 2024. Despite the rebound, SOL’s price is still down by 2.3% in the 14-day charts. Solana (SOL) may be gearing up for a major breakout beyond the $200 mark. Let’s discuss more.

Solana Makes Move Towards $200

SOL has experienced quite a few bearish months. The asset climbed to an all-time high of $293.31 on Jan. 19. Since its January highs, SOL’s price has dipped by 40.6%. SOL has struggled to gain momentum over the last few months.

SOL’s lacklustre performance could be due to the general market bearishness. Bitcoin (BTC) seems to have been the only highlight in the crypto market. While the crypto market did see a substantial rally in July, SOL could not maintain its gains. The asset climbed to the $205 mark for a brief moment, but faced a correction soon after. The dip was likely due to the Federal Reserve deciding to keep interest rates unchanged.

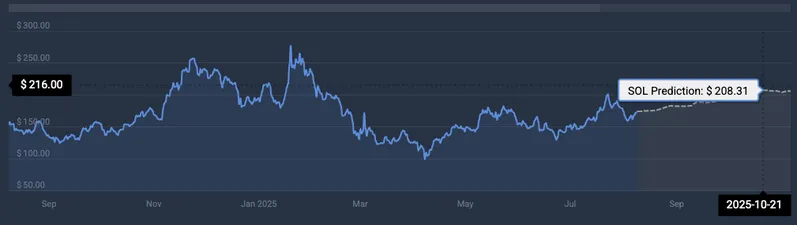

According to CoinCodex’s SOL analysis, Solana may continue to rally slightly over the next few weeks. The platform anticipates the asset to hit $208.31 on Oct. 21. Reaching $208.31 from current price levels will entail a rally of nearly 20%.

SOL’s latest rally may continue over the coming days. There is a high chance that the Federal Reserve will slash interest rates by 25 basis points in September. A rate may help propel SOL’s price beyond the $200 mark.

Also Read: Solana SOL ETFs Inching Closer: Invest Before Its Too Late?

There is also a chance that the crypto market will face a correction instead. Trade wars have led to a substantial increase in cautiousness among market participants. Economic uncertainty and a dip in investor confidence may cause SOL to lose momentum.