The Shiba Inu bear market is showing some pretty clear signs that it might actually be coming to an end right now. SHIB has been recovering from what many considered critical support levels, and along with that, we’re seeing XRP display some bullish reversal signals while Ethereum appears ready for a potential breakout. At the time of writing, these three major cryptocurrencies are painting a picture that suggests the broader bear market could finally be over.

Also Read: Will Shiba Make Me Rich? SHIB Breakout Can Turn $10,000 Into $160,000

Ethereum, XRP, and SHIB Signal End of Crypto Bear Market

XRP Shows Bullish Reversal Above Key Levels

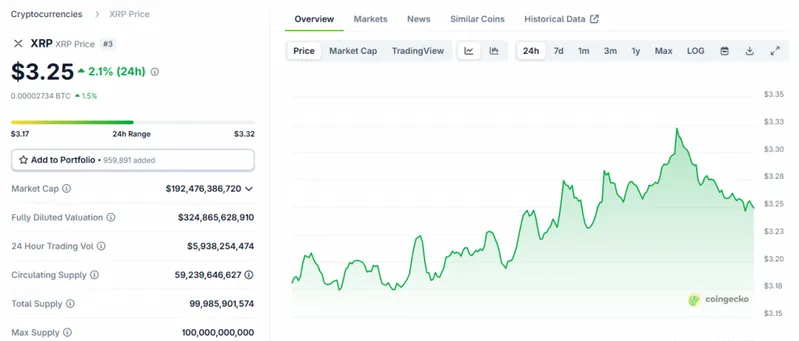

XRP has been finding some stability in the $3.10-$3.25 range, as CoinGecko reveals, and this comes after a pretty significant correction from its local high above $3.60. The price has actually been stabilizing above the 20-day EMA, with recent daily candles showing strong defense of support – which suggests that bulls aren’t giving up control easily right now.

What’s particularly interesting is how XRP has managed to hold its position above important moving averages like the 50-day and even the 100-day EMAs. The asset remains firmly within a larger uptrend, as indicated by the 200-day EMA’s position far below current price action. RSI readings around 61 suggest there’s still room for upward movement without creating overheating conditions.

Volume has declined from recent peaks, which is actually common following high-volatility moves. However, this consolidation has taken place without significant selling pressure, suggesting the recent decline was more of a breather than a direction change. If XRP manages to break above $3.30 with fresh volume, this bullish reversal could develop into a full continuation pattern.

Bears couldn’t push the asset below the crucial $3 psychological support, and this failure indicates the Shiba Inu bear market along with broader crypto weakness may be ending.

Shiba Inu Bear Market Shows Signs of Weakness

The Shiba Inu bear market appears to be losing steam as SHIB found support just above the 100-day EMA after falling below $0.0000145. In recent trading sessions, we’ve seen Shiba Inu bounce back above the 50-day EMA, and it’s been holding the $0.0000134-$0.0000141 range quite well.

This positive recovery indicates that market participants might still find value at these price levels despite the recent decline. The RSI at 53.63 shows there’s ample opportunity for upside movement without creating overbought conditions, and volume has increased somewhat too.

The bounce location is especially significant – it’s happening immediately after a retracement from multi-month highs and directly above layered support from both moving averages and previous price consolidation. This fits into what analysts call a traditional bullish continuation pattern. Local highs around $0.0000160 may actually be retested if SHIB recovers the $0.0000145 level, which would further confirm that the Shiba Inu bear market is coming to an end.

Shiba Inu Price Prediction and Market Outlook

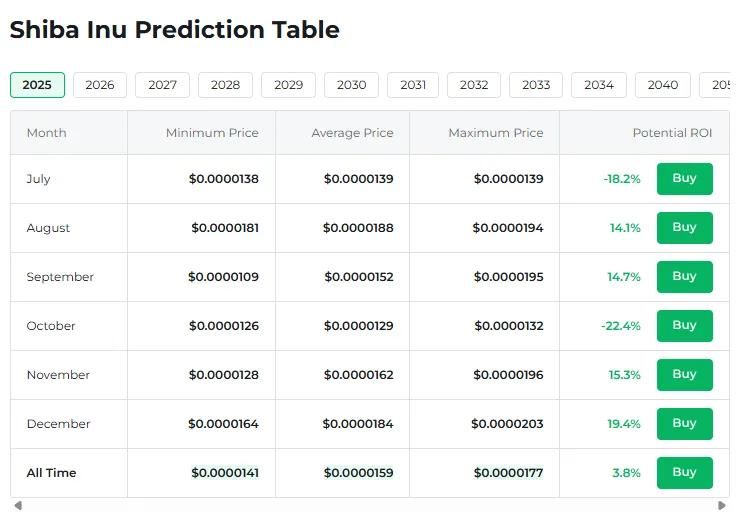

The current Shiba Inu price prediction shows mixed signals according to technical analysis. Changelly’s SHIB forecast for August 2025 suggests that it could reach an average trading price of around $0.0000143, with crypto analysts expecting the price to fluctuate between $0.0000134 and $0.0000151 during the month. This represents potential upside from current July levels.

However, the technical indicators present a cautious outlook right now. On the four-hour chart, Shiba Inu is bearish, with the 50-day moving average falling, suggesting a weakening short-term trend. This creates an interesting contrast with the longer-term predictions that show more optimistic Shiba Inu price prediction scenarios heading into August and beyond.

The broader market sentiment remains mixed, with technical indicators signaling about 36% bullish market sentiment, while the Fear & Greed Index displays a score of 67 (Greed). These readings suggest that even though the Shiba Inu bear market might be showing signs of weakness, traders are still exercising some caution in their approach.

Ethereum Ready for Potential Breakout

Ethereum is showing signs that it might break above the psychological $4,000 barrier while remaining stable around the $3,800 mark right now. Unlike most of the cryptocurrency space, ETH has demonstrated some pretty independent momentum, remaining largely unaffected by general market hesitancy.

Following an impressive parabolic rally in July, ETH has consolidated just below $3,800 on the daily chart. During high-velocity surges, it’s actually uncommon to maintain an elevated position without a significant retracement. This type of consolidation close to local tops typically indicates accumulation rather than distribution.

What makes ETH’s current setup even more intriguing is how it differs from the rest of the market. While assets like XRP and SHIB experienced volume drops and pullbacks, Ethereum has continued rising or at worst flatlined with minimal drawdowns. The 200-day EMA has been providing reliable support during the rally, with all moving averages trending upward.

The RSI is high at 79.46, but it hasn’t yet produced a clear reversal signal. The $4,000 level could be removed quite quickly if ETH breaks above $3,800 with significant volume, which would provide additional confirmation that the Shiba Inu bear market and broader crypto weakness are ending.

Also Read: Shiba Inu Price Crashes 12% But Whales Buy 4.66 Trillion SHIB—Rally Next?

Right now, we’re seeing a combination of factors that point toward the end of the current bear cycle. XRP’s bullish reversal patterns, clear signs that Shiba Inu bounces back from support levels, along with Ethereum’s sustained strength near major resistance all suggest the Shiba Inu bear market appears to be losing its grip on these major cryptocurrencies.