Samsung’s iPhone chip production is actually expanding in a big way through this new Apple partnership, and Samsung will be manufacturing image sensors right at its Texas facility. This Samsung iPhone chip production deal is positioning the stock for some potential gains amid favorable tariff policies and, well, a strengthened US manufacturing presence.

Apple stated:

“By bringing this technology to the US first, this facility will supply chips that optimize power and performance of Apple products, including iPhone devices shipped all over the world.”

Samsung’s iPhone Chip Production Ramps Up Amid Tariffs and Texas Deal

The Apple Texas chip deal involves Samsung producing these three-layer stacked image sensors for the iPhone 18 at its Austin facility. This actually represents the first commercial deployment of this advanced technology globally, which gives Samsung’s iPhone chip production capabilities a real competitive edge right now.

Lee Jong-Hwan, professor of semiconductor engineering at Sangmyung University, stated:

“Samsung seems to have won this deal from Apple because of the imminent tariffs on foreign chips.”

Trump chip tariffs are threatening 100% levies on imported semiconductors, but Samsung’s US investments provide protection. South Korea’s trade minister actually confirmed that Samsung would avoid these Trump chip tariffs through some recent bilateral agreements.

Also Read: Samsung Lands $16.5B Tesla Deal to Supply AI Chips for EVs

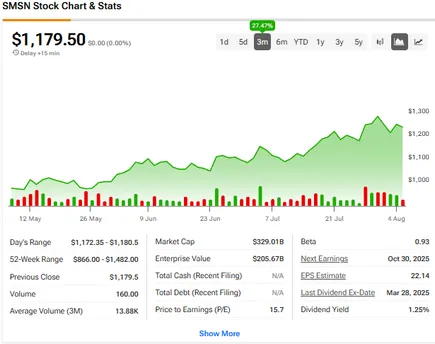

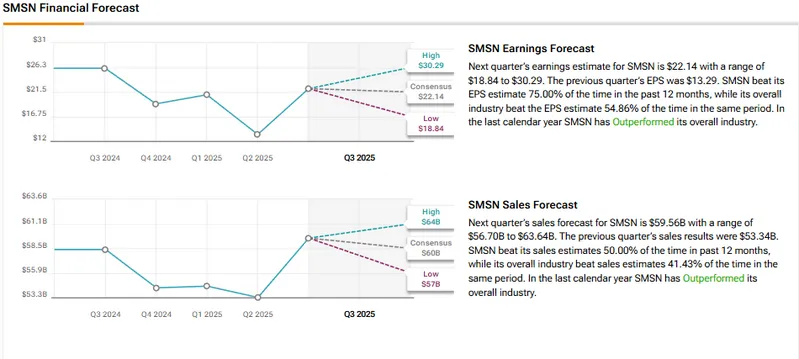

Strategic Recovery Boosts Samsung Stock Prediction

This Samsung iPhone chip production partnership breaks Apple’s exclusive relationship with Sony for image sensors. The iPhone 18 image sensor contract, along with Samsung’s $16.5 billion Tesla AI chip deal, supports bullish Samsung stock prediction targets.

Pak Yuak, analyst at Kiwoom Securities, had this to say:

“It is not a big-size deal, but it is still meaningful that Samsung became another supplier for Apple in addition to Sony, which was a sole supplier for Apple’s image sensors. This deal will boost Samsung’s US plant operating ratio and help reduce its foundry losses.”

The iPhone 18 image sensor technology enables superior smartphone photography capabilities. Samsung’s Texas facility will be supplying these advanced sensors globally, which strengthens the company’s market position and supports Samsung stock prediction models targeting $1,600.

Also Read: Trump, Apple Announce $100B US Deal, AAPL Stock Set to Rally

It seems that Samsung is getting ahead of the curve in terms of its strategic investment into manufacturing facilities within the United States which is being remodeled by tariffs on semiconductor chips set by Trump. Apple Texas chip transaction explains how Samsung iPhone chip manufacturing capacity can harness the geopolitical change and ensure technological progress on mobile imaging system.