Ryanair tariff war concerns have emerged as the company’s primary threat to future growth plans right now. It further highlighted the fact that both the removal of tariffs between China and the United States and changes in currency rates could impact its business in the coming months. The media is of course monitoring all NASDAQ: RYAAY information and analysts expect its price to eventually reach a sum of $60 in spite of the troubles right now.

Also Read: Tesla (TSLA) vs BYD: $157B Giant’s 416K Sales Outpace Musk’s $200B Robotaxi Bet

Tariff Risks, China-US Tensions, And Analyst Targets Explained

Tariff War Concerns Dominate Outlook

Lately, Ryanair CEOs have been drawing investor attention to tariff wars. According to the airline, disagreements among nations in international trade make it most challenging to realize their future plans.

Also Read: US Tariffs to Drag Euro-Area Inflation to 1.7%, EU Forecast Reveals

Ryanair CEO Michael O’Leary stated:

“The tariff war remains the top threat to our growth plans.”

It was mentioned by top-ranking officials of the airline that China-US discussions on tariff exemptions could negatively influence their business. Still, since negotiations about the deal are ongoing between top economies, the situation is not yet certain.

Analyst Optimism Despite Challenges

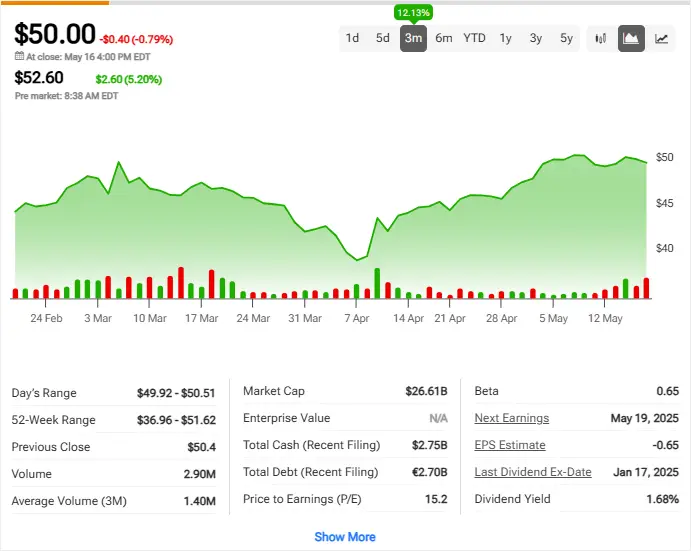

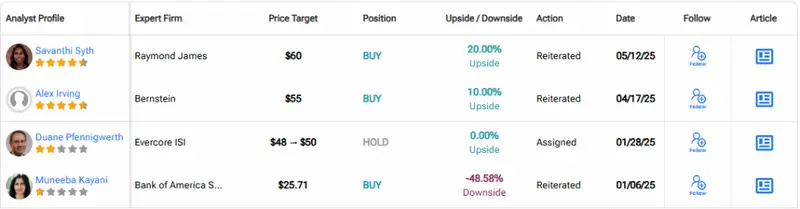

Despite these hurdles, Wall Street analysts remain relatively confident in Ryanair’s prospects. The NASDAQ: RYAAY stock has a consensus of “Moderate Buy” rating as we speak. The price targets are showing important upside potential for investors. About time, right?

Raymond James analyst Savanthi Syth said:

“While macroeconomic headwinds exist, Ryanair’s cost structure and market position provide competitive advantages that should enable the company to navigate tariff-related challenges better than peers.”

Currency fluctuations represent another key concern for the airline, which operates across multiple economic zones. These Ryanair tariff war and currency risks are being closely monitored by investors who are tracking the stock’s performance against broader market indices.

Also Read: Class Action Lawsuit Filed Against Michael Saylor’s Strategy Over Bitcoin

Financial Position Remains Stable

Despite facing some difficult times, Ryanair remains robust still, and has a value of about $26.61 billion. By paying a dividend of 1.68%, the airline awards its shareholders an earning potential at its present P/E ratio of 15.2.

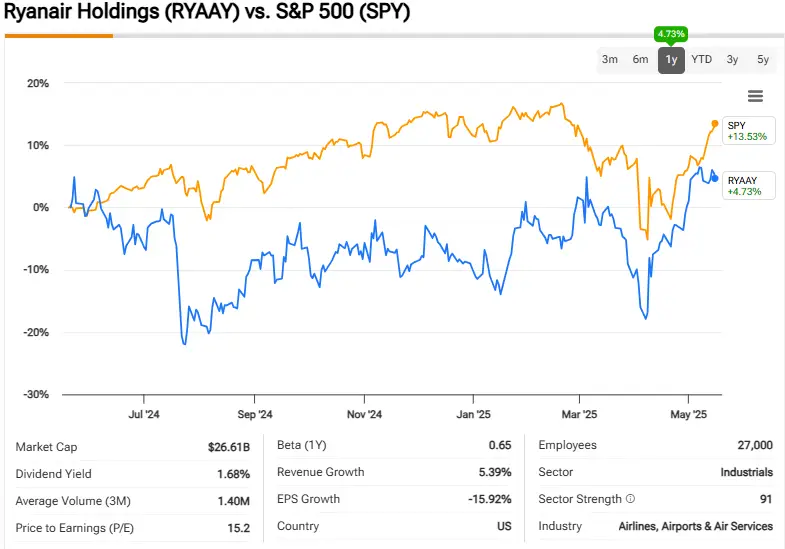

China US tariff exemptions discussions and United States news regarding trade policy continue to influence the stock’s trajectory. The NASDAQ: RYAAY shares have recently recovered some ground after periods of underperformance compared to the S&P 500 index.

The company’s ability to navigate these Ryanair tariff war concerns while maintaining its growth trajectory will likely determine whether analyst targets around $60 prove accurate in the coming months.

Also Read: India Rejects Global South’s De-Dollarization Agenda: “Absolutely No Interest”